Diamyd Medical — Pricing the Binary Bet Ahead of the Phase III Interim Readout

Our martingale model shows the market pricing a 34 % success probability and a nearly 200 % upside in the positive scenario. There is also room for sentiment to improve long before the catalyst.

Company Description & Key Facts

Background

Diamyd Medical is a Swedish biotechnology company dedicated to developing antigen‑specific therapies for type 1 diabetes. The lead asset is now being evaluated in a pivotal Phase III trial in stage three patients. An interim analysis, scheduled for March 2026, represents the most important near‑term value‑defining event for the company.

Funding

To finance the Phase III study, Diamyd completed a rights issue and directed share placement that raised SEK 267 million in gross proceeds. The transaction included the issuance of series TO5 warrants, each entitling the holder to subscribe for half of one new share at SEK 20 after the interim readout. Because the warrants mature only after the data cut‑off, they provide a contingent source of capital that becomes available if the study reads out positively. Access to this additional funding would leave Diamyd with a strengthened balance sheet and the financial flexibility required to pursue partnership discussions and prepare for commercialisation.

Key facts

Share count: 137 million

Outstanding series TO5 warrants: 34 million

Maximum new shares from warrants: 17 million

Maximum gross proceeds from warrants: SEK 336 million

TO5 subscription period: April 16 2026 to, and including, April 30, 2026

Key Assumptions & Parameters

Interim Readout Is Binary In Nature

DIAGNODE‑3 is a placebo‑controlled, randomised and double‑blinded Phase III trial that will enrol 330 patients, of whom the first 170 contribute to the interim analysis. The interim readout captures clinical status 15 months after the first injection, whereas the final analysis will add a further nine months of follow‑up.

Management expects the interim data to be sufficient for a biologics licence application (BLA). Success therefore requires a clinically meaningful and statistically significant improvement in stimulated C‑peptide versus placebo. A meta‑analysis of earlier data sets indicates that such an effect size should already be evident at the 15‑month mark. Anything short of a clear and statistically robust signal would be a major disappointment.

Failure at the interim would force a strategic reset of the entire development programme and would leave the company with limited cash runway. In that downside scenario we ascribe value only to the remaining SEK 150 million in cash and to the manufacturing plant, equating to roughly SEK 1,5 per share.

Conversely, if the interim readout delivers, the share price response will scale with the magnitude of the clinical benefit. Our valuation framework therefore models a symmetrical distribution around an average positive outcome. A convincing data set would lift the probability of ultimate regulatory approval to 90 % or higher.

Valuation Methods for the Warrants

Black-Scholes Framework

The Black‑Scholes framework is ill‑suited because its core diffusion assumption clashes with the Diamyd’s binary catalyst. Black‑Scholes prices options on the premise that the underlying share follows a continuous log‑normal path whose uncertainty accumulates smoothly through Brownian motion. In contrast, the interim readout creates a deterministic moment at which the price must jump either to a high “success” level or to a low “failure” floor. That discontinuity cannot be captured by a constant‑volatility diffusion, and the associated jump also invalidates the model’s delta‑hedging rationale, which relies on infinitesimal, hedgeable moves rather than step changes. Black‑Scholes would therefore misallocate probability mass and misstate time value, thus being unsuitable for this application.

Martingale Model

Instead of forcing continuity and diffusion where none exists, we adopt a martingale approach. The fundamental theorem of asset pricing tells us that in an arbitrage‑free market there exists a risk‑neutral measure 𝑄 under which all traded prices, discounted at the risk‑free rate, evolve as martingales. That result is model‑agnostic: it holds whether the underlying follows a diffusion, a jump process or, as here, a one‑off binary jump.

The martingale framework delivers risk‑neutral probabilities, not real ones. To arrive at an economic or clinical probability p we must undo the change of measure by inserting the asset’s real drift and the up & down factors that proxy volatility. This step re‑weights good and bad outcomes, restoring the risk premium that the market demanded and translating the q-probability into the real‑world probability p. We perform that transformation explicitly in later, allowing you to compare market‑implied risk perceptions with your own scientific or fundamental assessments.

Pricing the TO5 Warrant

We value the series TO5 warrants as a European call options on Diamyd’s share. Any dilution is already reflected in the stock price, and full exercise of all TO5 warrants would expand the share count by only approximately 10,9 %, a level that is nearly negligible.

Using a risk‑neutral martingale framework we calculate the current warrant price as follows:

Under the modelling assumptions the warrant has no value if the interim readout is negative. In a positive outcome the share price must exceed SEK 20, otherwise the funding outlook would remain uncertain and further dilution could not be ruled out. On that basis the expression simplifies to

Solving the equation across a range of post‑success share prices gives the corresponding risk‑neutral probabilities. The resulting pairs are summarised in the table below:

Deriving Market Expectations

The current share price can be viewed as the expected share price at warrant expiry, discounted back to today. In contrast to the warrant, the share retains residual value even in the negative outcome:

Together with the warrant‑pricing expression we now have two equations that pin down both the probability of a positive interim readout and the share price in that scenario. Expressing the risk‑neutral probability q as a function of the post‑success share price via the warrant equation yields:

Substituting this relationship into the share‑pricing equation and solving gives a closed‑form expression for the share price in the positive scenario:

Applying the input parameters produces a post‑success share price of SEK 34,25 and a corresponding risk‑neutral probability of 28,70 %.

What Do Future Price Movements Tell Us About Market Expectations?

If we hold either the share price or the warrant price fixed we can see how the market must adjust the risk‑neutral probability of success q and the post‑success share price. Mathematically this amounts to taking the derivative of our valuation equations with respect to one variable while treating the other as a constant. The result shows how the two parameters must move to keep both instruments priced consistently.

The Warrant Appreciates While the Share Remains Constant

Let’s denote:

With these definitions the equations for the share and the warrant prices become:

Rearranging the share‑pricing equation gives q as a function of the share price in the positive scenario:

This gives us the following equation for the warrant price:

Substituting this result back into the warrant‑pricing equation and differentiating with respect to the post‑success share price yields:

The derivative is positive. A higher warrant price therefore requires a higher value for the share in the positive scenario if the share price itself has not moved. Conversely a lower warrant price forces the implied post‑success share price downward to maintain equilibrium.

Changes in Every Scenario

Much as we examined the warrant‑only move we can evaluate how each instrument must respond when the other variable changes. By applying the same differential approach we derive the market‑consistent shifts in the risk‑neutral probability and the post‑success share price for all four permutations:

Sensitivity Analysis

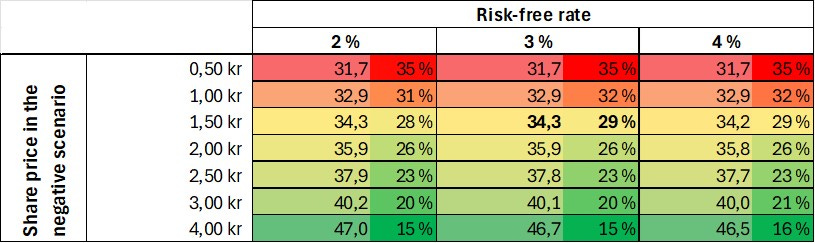

Changes in the risk‑free rate have only a marginal impact on the share price in the positive scenario and on the implied probability of success. However, the residual value of the share in the unsuccessful scenario materially shifts the parameters:

Translating Risk‑Neutral q Back to Real‑World p

The pricing analysis above yields a risk‑neutral success probability of 28,7 % This figure is mechanically low because, under the q‑measure, every cash flow is discounted at the risk-free rate. To obtain an economically meaningful probability we restore the risk premium that investors require. Concretely, we replace the risk‑free drift in the one‑step binomial tree with 13 % WACC, compute the implied growth factor and recalculate the up and down weights. This adjustment raises the success probability to approximately 34 %. The market is therefore signalling that roughly one interim readout in three would be strong enough to justify a share price of SEK 34,25. You can benchmark this assessment against your own view of the trial design, earlier data sets and historical success rates.

The move from q to p alters only the probability weights, not the terminal pay‑off levels, therefore the share price in the successful scenario stays the same. As a result the warrant’s attractiveness rests on two levers, namely investors’ confidence that the Phase III signal will beat market odds and the size of the share price jump if that scenario materializes.

Upside:

Downside:

Drift:

Expected growth factor:

Probability in the p-measure:

We can now derive the implied share price at warrant expiry to confirm consistency:

Discounting that value back to the present gives:

The result returns to the starting share price, confirming that the conversion from q to p is coherent with the observed market prices.

Conclusion

The market is currently pricing in a 34,1 % chance that Diamyd will deliver a positive DIAGNODE‑3 interim readout. In that success case the implied share price is SEK 34,25. This level represents a 197 % gain relative to today’s share price and about a 170 % gain to the price that a 13 % WACC implies for the stock immediately before the interim readout. Conversely, the model implies that an unsuccessful interim readout would lead to an 87% decline from today’s share price.

If the readout is positive Diamyd would hold roughly SEK 400 million in cash straight after the event. This cash balance equals about 2,60 per share before accounting for the few liabilities that the company holds. A share price of 34,25 would give Diamyd a market value of around SEK 5,3 billion which corresponds to approximately $550 million or €470 million.

These valuation markers appear conservative. They imply that investors could capture an attractive return even without staying in the position through the binary catalyst provided that sentiment strengthens as the readout date approaches.

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance.