Faron Pharmaceuticals — Ahead of Critical Decisions

A rich newsflow is expected from Faron. A set of current indicators provides useful clues to what may come next.

Faron Pharmaceuticals is a Nordic biotechnology company listed on First North Helsinki and on the AIM market in London. The company develops immuno-oncology therapies with bexmarilimab as the lead asset and is preparing for Phase III. Faron is in a strong position to advance its clinical programs through multiple pathways.

In this article, we gauge aspects of the contemporary issues surrounding the company, including the upcoming Phase III study and financing options.

HCM Bond

In spring 2025, Faron entered into a convertible bond agreement with Heights Capital Management (HCM). The agreement included three tranches, the first of which was drawn immediately, mostly to repay the IPF loan facility. The second and third tranches are yet to be drawn. Here are the main terms of the first tranche bond:

Size: €15 million principal, issued at 92.5 % of par

Maturity: 2 April 2028 (three-year tenor)

Coupon: 7.5 % p.a.

Amortization: 18 equal installments, beginning on June 2, 2025

Conversion price: €2.94 (20% premium)

Settlement: Cash or shares at 90% of VWAP

The second and third tranche bonds have similar terms except for the nominal amount of €10 million. The notable difference, however, is that the issuance of the second tranche bond effectively grants HCM a call option in the form of the third tranche bond, exercisable during a twelve-month period starting six months after the issuance of the second tranche bond. For more information about the convertible bonds arrangement, please refer to our earlier issue here.

Effective Interest Rate of the Convertibles

The convertibles are issued at a reasonable 7.5 % coupon. However, the coupon is merely a technical figure, functioning as a basis for computing the periodic interest. Thus, it should not be confused with the cost of the loan or the return on investment for HCM. We can solve the effective interest rate (EIR) numerically by summing the future cash flows.

This gives us an interest rate of 2.16 % for every two-month period, which equates to:

Faron has indicated that it opts to cover the installments in shares instead of cash. As per the terms, the in-share payments are conducted at a 10 % discount to the market price. This effectively increases each cash flow by the inverse of 90 %, resulting in an actual EIR of 22.47 %, nearly double the previous figure.

In addition to the above, HCM has the right to:

Convert the bonds into shares at the conversion price that is subject to recalculation in the event of dilution

Advance up to two installments between the scheduled bimonthly installments (at most nine advanced installments during the first year)

Issue the third tranche bond by a unilateral decision (within a specified time window, after the second convertible has been drawn)

Conversely, Faron has the right to choose whether to satisfy the installments in cash or in shares.

All of these rights have monetary value to the holder, but it is difficult to measure them numerically. This is problematic because, under IFRS, the bond must be measured at fair value.

Accounting of the Convertibles

International Accounting Standard (IAS) 32 determines whether the instrument is debt or equity. In this case, the convertibles are classified as a financial liability because the conversion options may vary in the number of shares, as the conversion price is subject to adjustment in the event of dilution.

Furthermore, IFRS 9 classifies whether the financial liability should be measured at amortized cost, fair value through other comprehensive income (FVOCI) or fair value through profit or loss (FVTPL). FVTPL is the only available option because the conversion options are included.

Finally, IFRS 13 is used to determine the fair value of the instrument. The convertibles are classified as Level 3, as their value depends on unobservable inputs, namely events such as Qualified Equity Offerings (QEO, which affect the conversion price), Change of Control (CoC, e.g. a buyout) and the proportion of cash payments. These variables are impossible to predict or observe, thus the only way to capture their effect is to employ a Monte Carlo approach that can reflect the interdependence of the variables. This is also required to ensure the convertibles are correctly valued on the balance sheet.

Monte Carlo Analysis of the Convertibles

As a result, Faron has conducted an analysis for accounting purposes to determine the fair value of the convertibles (i.e., the price at which the convertibles would trade). The analysis is conducted in conjunction with the half-year reports. Specifically, the following parameters apply to the situation on June 30, 2025:

As of publication of this article, Faron has paid 5 installments, thus there are still 13 installments left. Of the 5 installments, only one has been paid in cash, resulting in a cash-paid ratio of 20% as opposed to the anticipated ratio of 50%. To arrive at a ratio greater than or equal to 50%, Faron should choose to cover at most 5 of the remaining 13 installments in shares. A ratio below 50% would result in a higher fair value of the convertible.

Additionally, the share price has decreased materially since the analysis, limiting the value of the option to convert the convertibles into shares.

Moreover, it is worth noting that the QEO rate per year is a parameter in a Poisson process, not the likelihood of an equity offering. The likelihood of an equity offering can be calculated from the rate parameter lambda:

As a result, a fair value of €19.408 million was reported, as opposed to the remaining principal value of €14.167 million. The share price was close to its level on the date of issuance of the first tranche (€2.4496), supporting the accuracy of the forthcoming calculations.

Converting the Monte Carlo Result to a Comparable Non-Convertible Bond

Now, we would like to know what the coupon rate of a comparable bond with a fixed payment schedule would be. That is, a bond where the option value of the convertible option and other perks are woven into the coupon.

We do this by discounting the deterministic cash flows using the risk-free rate to achieve consistency with the Monte Carlo analysis.

The deterministic future cash flows must equal the present fair value:

where the periodic cash flows are:

This gives us the coupon:

which yields approximately 27 %, as opposed to the original coupon of 7,5 %.

Conclusion

This example does not seek to provide exact answers but rather to illustrate how a major part of the value of the convertibles is tied to the conversion options. On the other hand, this suggests that the cost of the convertibles is reasonable in the event that the options expire valueless.

To put this into context, Faron has been funded through equity and pure debt financing until the HCM bonds were issued. Why would Faron choose convertibles right before it is set to enter into a groundbreaking partnership with Big Pharma, significantly increasing the value of the convertibles while eroding the long-awaited reward for ordinary shareholders? The only way this would be a sound decision is if management believes that the option value of the convertibles is negligible. In that case, the price of the convertibles would be sensible compared to earlier equity issues and, more notably, the previous IPF loan that carried interest at EURIBOR + 9 % on top of expenses and warrants.

BEXMAB02 - The Phase II/III Trial

The upcoming trial is set to include a dose optimization phase before advancing to the proper Phase III, contingent on strong results. The dose optimization phase would be the first chance for the drug to generate valuable controlled data in a blinded manner. It marks an important de-risking milestone for the whole project, translating into significant upside potential for the risk-adjusted value of the project. Additionally, the costs of the Phase II part would be bearable for Faron, making the advancement to Phase III a natural inflection point for partnering. It would also be a natural spot for Faron to relinquish the sponsor role to a Big Pharma partner.

What Do the Recent Hires Tell Us About the Sponsor of the BEXMAB02 Trial?

In September, Faron announced three full-time positions simultaneously that appear to be closely connected to the upcoming trial. The vacancies suggest that Faron is in need of talent for an extended period, indicating that Faron will sponsor at least the initial part of the upcoming trial. Now let’s take a look at what the roles are and some extracts of their respective descriptions:

1. Clinical Quality Assurance/Systems Manager

The Clinical QA/Systems Manager plays a critical role within Clinical Operations ensuring compliance with regulatory and internal requirements, while fostering a culture of quality, continuous improvement, and cross-functional collaboration. Clinical QA/Systems Manager also encompasses oversight of clinical systems, data governance, system validation, and vendor management, including services provided by CROs. Therefore, the ideal candidate for this new role will have in-depth knowledge and experience in clinical quality assurance, and preferably also with clinical systems in biotech or pharmaceutical industry.

Key responsibilities include:

Develop and maintain clinical trial data and quality management processes

Oversee trial data quality by identifying risks, ensuring traceability across systems and vendors, and reviewing clinical trial documentation

Lead Computer System Validation (CSV) activities on the sponsor side

Provide QA input during protocol development, site selection, vendor qualification, and trial execution

2. Senior Clinical Research Associate

The Senior CRA (Clinical Research Associate) plays a pivotal role in ensuring the quality and integrity of site management activities in clinical trials. The ideal candidate will have in-depth knowledge and experience in overseeing CROs and in trials investigating haematological malignancies. The goal of Faron Clinical Operations is to work consistently and with precision to advance our development programs, and we hope to find a like-minded professional to join our team.

Key responsibilities include:

Serve as the primary sponsor contact for CRO and investigational sites regarding monitoring. Facilitate clear and consistent communication among all parties.

Oversee the site monitors and conduct sponsor oversight monitoring visits globally

Support site selection and other activities related to investigational sites

3. Regional Clinical Trial Manager

The Regional CTM is responsible for the operational oversight and execution of clinical trials within a designated region. The Regional CTM serves as the primary regional point of contact for investigational sites, Contract Research Organizations (CROs), and vendors, and plays a key role in driving study timelines, quality, and performance. The ideal candidate for this new role will have in-depth knowledge and experience managing Phase II-III trials across multiple countries or regions, preferably in haematological malignancies.

Key responsibilities include:

Lead regional execution of clinical trials from start-up through close-out, ensuring adherence to timelines, budgets, and quality standards

Oversee regional site activities in collaboration with CROs and internal teams

Role is European based but may require travel and ability to accommodate different time zones

Together these vacancies leave little room for speculation: Faron will at least initiate the trial as the responsible sponsor, which is inconsistent with the notion that a Big Pharma partner – with superior resources – would take over the project in connection with a licensing deal in the near future.

Moreover, these vacancies were posted in early September. Would Faron have committed to hiring such talent if intense negotiations were taking place? The roles would have been redundant if the licensee had taken the sponsor role, thereby carrying the responsibilities of the above roles.

This sequence most likely suggests that Faron does not expect to enter into a conventional license agreement at this stage. In that scenario, Faron would likely aim to partner after the Phase II part of the trial to secure a better deal. On the other hand, it could suggest an unconventional agreement that involves some sharing of costs and responsibilities.

Financial Position

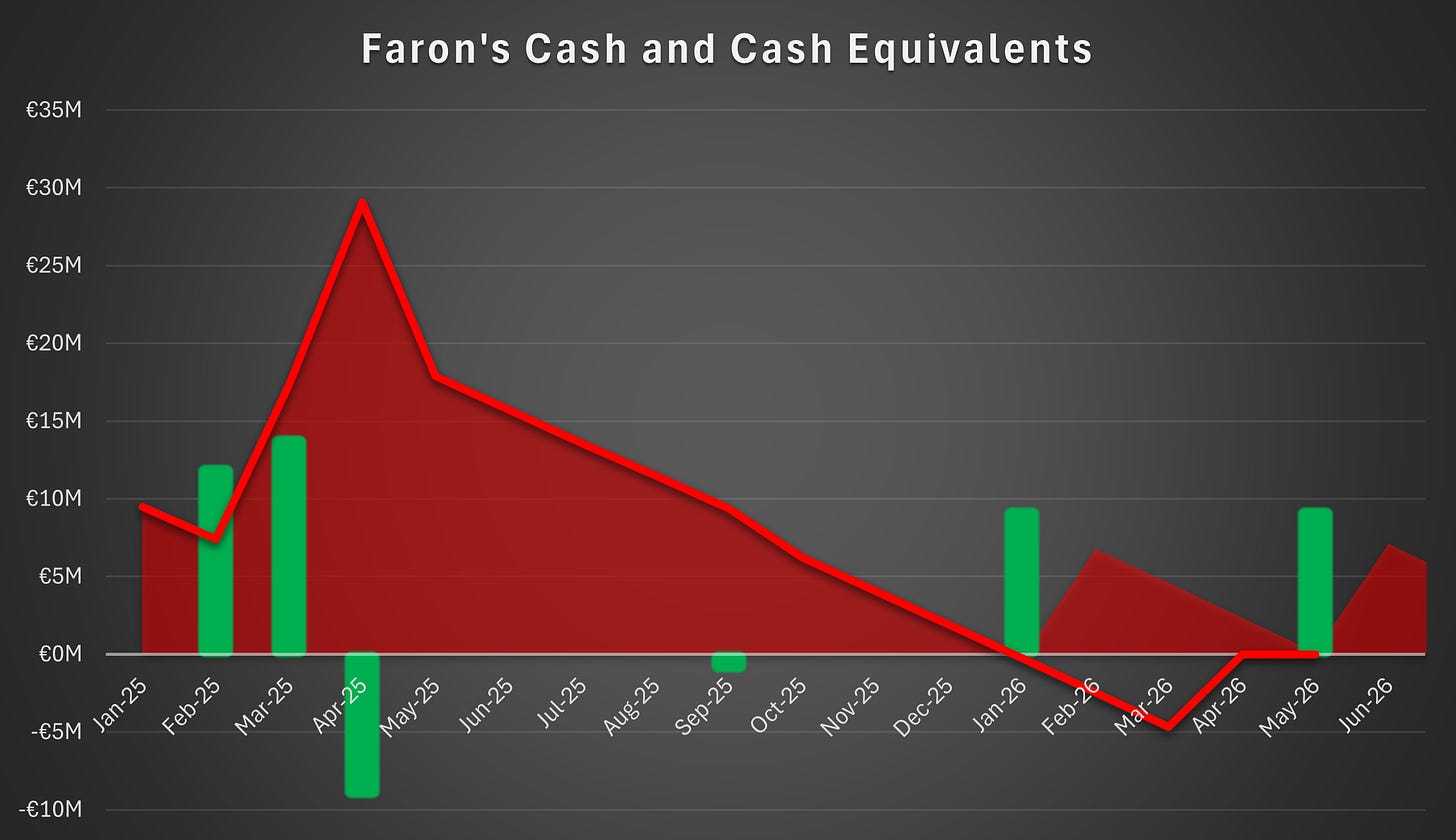

Faron has sufficient cash to fund operations until early January. The company must secure further financing urgently to ensure continuity. For a more detailed view of the available options, please refer to our earlier issue here.

There are currently three options:

Issue the second tranche convertible

Secure equity financing through a share issue

Secure non-dilutive funding through a partnership in the form of an upfront licensing payment

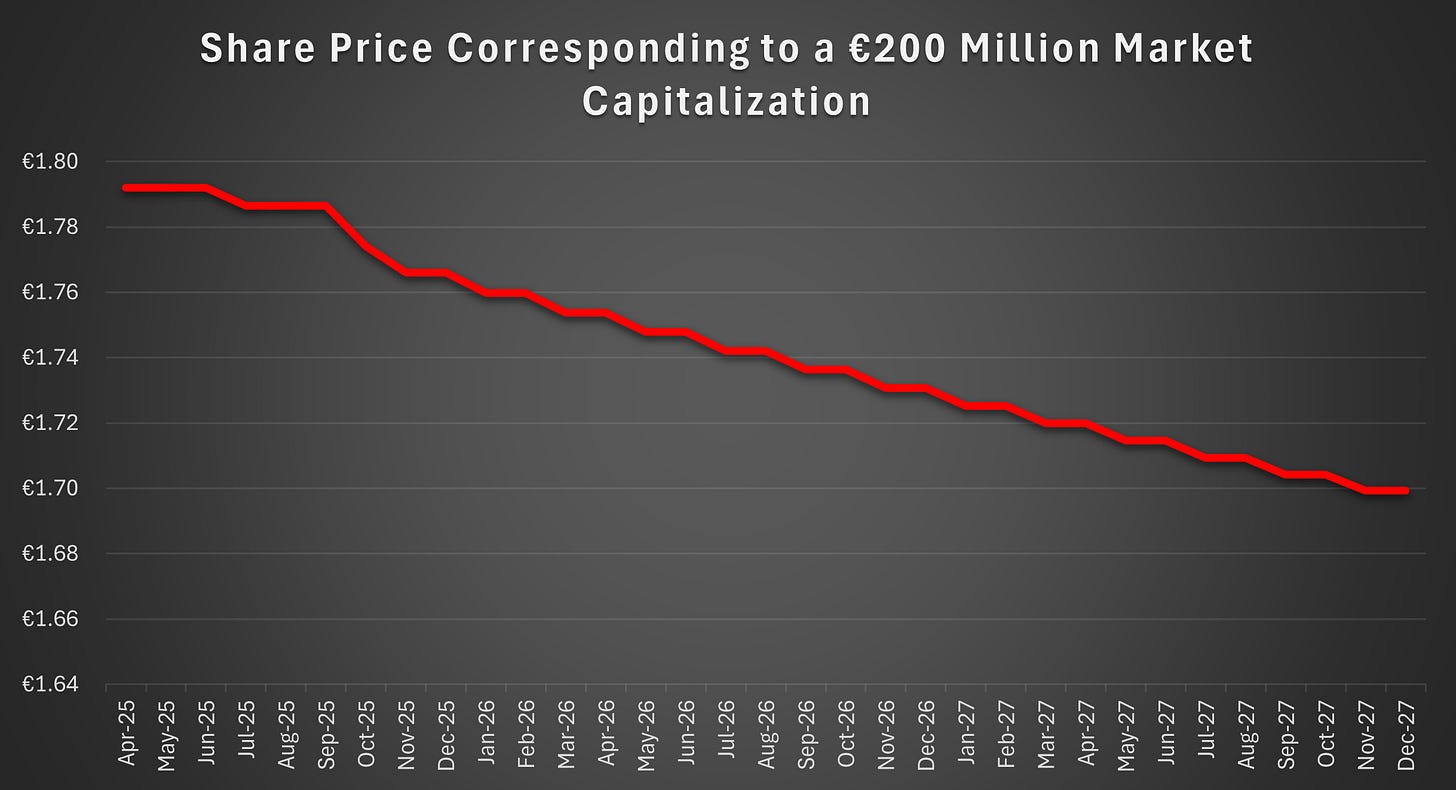

All of the above options depend on Faron’s bargaining power. The second tranche convertible is available for issuance solely at Faron’s discretion as long as the market capitalization of Faron exceeds €200 million. The market capitalization excludes any treasury shares. Therefore, market capitalization increases in conjunction with the in-share installments of the convertibles, provided that the share price remains stable.

It is crucial for Faron that the share price remains above the required level at all times. If it were to fall below the threshold, the convertibles would no longer be available, hindering Faron’s bargaining power in ongoing financing negotiations, including possible equity issues and partnership discussions. The second tranche convertible may not be the most attractive form of financing for Faron, but its availability is nonetheless valuable to the company.

What Happens If the Share Price Falls Below the Threshold?

If the share price were to fall below the threshold, we believe that it would trigger further downward pressure on the share price, as the likelihood of having to resort to equity financing in a tight spot would increase. However, we believe that HCM would be willing to issue the second tranche even if the terms are not met, given the favorable return profile that the bond offers for HCM. Before that, however, we must understand why HCM negotiated such a term into the agreement.

What HCM Wants

The remaining terms are as follows:

The arithmetic mean of the daily traded value of the Shares on each dealing day comprised in the three-month period preceding the issuance of the Second Tranche Bonds is greater than EUR 500,000

The Company has a market capitalisation greater than EUR 200 million on the date of issuance of the Second Tranche Bonds.

The first term is designed to ensure that HCM can liquidate the in-share payments at a desired time at the prevailing market price. It suggests that HCM is not aiming to speculate with share price development, but rather to collect the proceeds.

The second term is far more likely to be breached. It ensures that HCM is not forced to further finance Faron if its financial position were to deteriorate.

Taken together, this suggests that HCM is concerned with the current share price only to the extent that it indicates Faron has sufficient cash reserves to continue operating without disruption. Based on this, we foresee that HCM would require an equity investment of equal or slightly smaller size in order to lift the above terms.

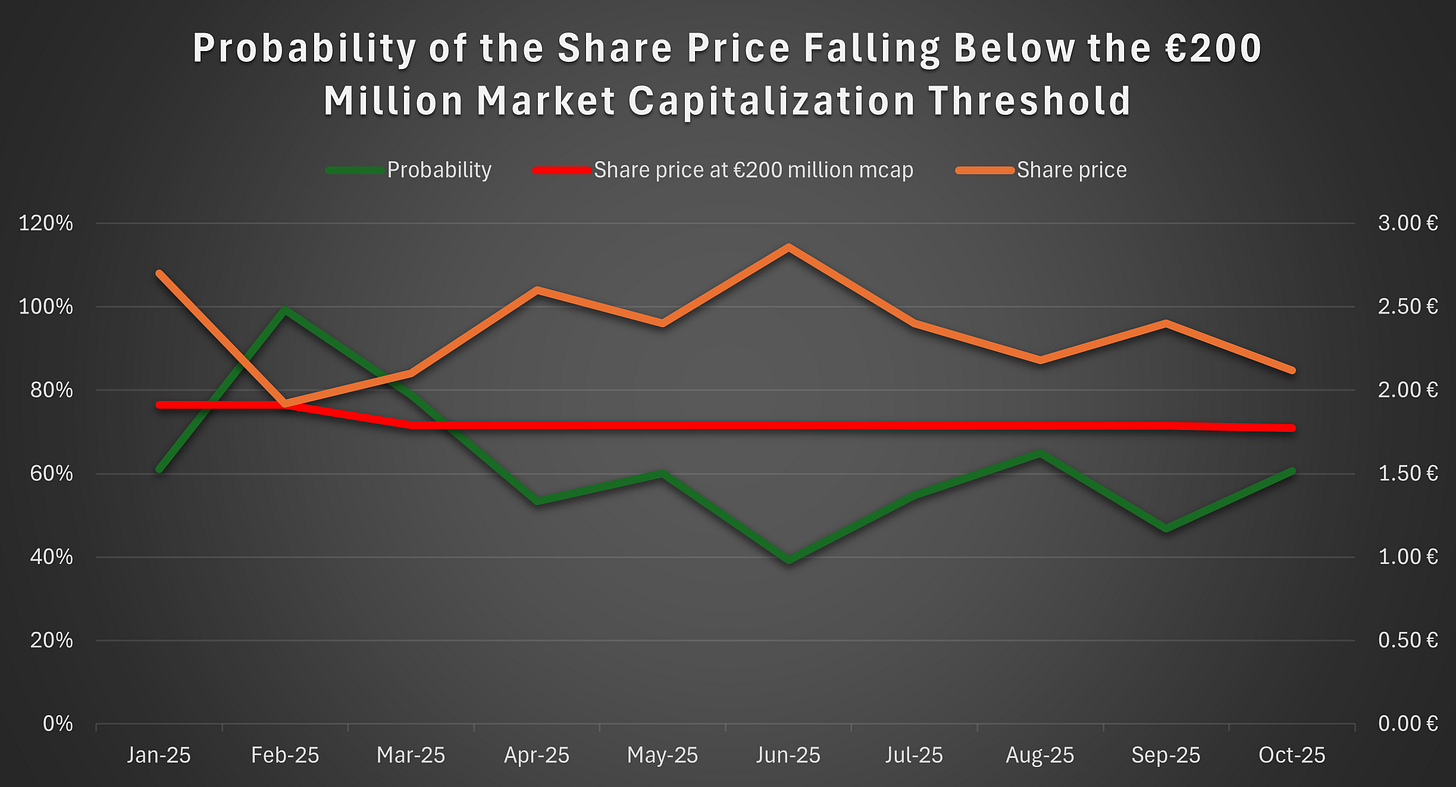

The Likelihood of the Share Price Falling Below the Threshold

We can compute the probability that the share price falls below the threshold before the end of the year using a stochastic model of Faron’s share price movements. The result represents the likelihood of the share price dipping below the threshold, whether momentarily or for longer. We use the Q-measure and parameter values consistent with earlier calculations and Faron’s internal figures used in reporting.

Now let’s model the stock price as a geometric Brownian motion:

By setting…

and applying Itô’s lemma, integrating, and exponentiating, we obtain:

This is lognormally distributed and thus strictly positive. Now let’s denote

Integrating yields:

The desired probability reduces to:

This yields a closed-form expression for the likelihood, which is straightforward to compute using the standard normal distribution’s cumulative distribution function:

This gives us the following figure: the likelihood amounts to 61% as of October 1, up from 47%. The increase reflects the decline in the share price from €2.4 to €2.1 over September.

The likelihood is relatively high, suggesting that Faron is in no position to delay securing further financing. This is apparent to all parties, which could hinder Faron’s negotiating position on all fronts and thus decrease the likelihood of securing an agreement valuable enough to hand over the commercial rights. Based on this, we project that Faron must act before the end of October to remain in the driver’s seat.

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance. Although every effort is made to ensure accuracy at the time of publication, errors or omissions may occur. Always corroborate key facts with multiple reputable sources and, where feasible, trace assertions back to the original source material. References to third-party content are provided solely for convenience and do not imply endorsement, and no responsibility is assumed for their completeness, reliability, or timeliness.