Faron Pharmaceuticals — Navigating the Financing Choices to Phase III

Strong data opened the door to Phase III, but funding will decide the pace. Faron can team up with big pharma or rely on equity investments and convertibles. We assess the feasibility of each choice.

Faron Pharmaceuticals is a Nordic biotechnology company listed on First North Helsinki and on the AIM market in London. The company develops immuno-oncology therapies with bexmarilimab as the lead asset and is preparing for Phase III. Faron is in a strong position to advance its clinical programs through multiple pathways.

Partnerships

Faron and its CEO Dr. Jalkanen have repeatedly stated that the company aims to secure partnerships with larger pharmaceutical companies to advance its clinical programs beyond Phase II. The company has pursued such an agreement for a long time. However, previously indicated timelines have slipped several times, which reflects the challenges of reaching terms in a difficult market for Nordic small-cap biotechs that depend on outside funding.

Faron seeks an agreement in which the partner fully funds the Phase III trial and provides a substantial upfront payment in exchange for rights to commercialize bexmarilimab in the United States or potentially worldwide. To justify such terms, the partner would need to share the view that the asset has significant market potential and, most importantly, a high probability of regulatory approval.

It is difficult to gauge prospective partners’ risk appetite at this stage. That said, the probability of securing a transaction has arguably improved following the strong clinical results presented in August. Given the limited visibility and the existence of other viable strategic paths, a scenario-based approach to valuing Faron is warranted.

Potential Timings for a Partnership Agreement

A partnership could materialize at one of the following points:

Before the initiation of the Phase III study

After the initiation of the Phase III study but before the interim readout

After the interim readout

In the first scenario, the partner would likely fund the entire Phase III study. In the second scenario, Faron would initiate and technically fund the study on its own, with partner funding arriving after initiation. This would require equity financing, potentially complemented by the remaining HCM bonds. The third scenario would require the largest amount of financing and would likely involve multiple sizable funding rounds. This article focuses on the latter two scenarios, both of which require additional financing beyond the current cash reserves.

Timing Matters

If the initiation of the Phase III study were delayed, it would shorten the period during which Faron’s drug bexmarilimab would benefit from market exclusivity. This would reduce the company’s future cash flows. A delay would also push back the timing of regulatory approval, which would have the same negative impact. For these reasons, it is in Faron’s best interest to advance the study as quickly as possible, increasing the likelihood of the latter two scenarios.

If no suitable partnership agreement is available, Faron should, in our view, proceed by funding the Phase III study independently. The company has on several occasions demonstrated its ability to raise capital at attractive valuations. For a more detailed discussion on why we believe self-funding is a feasible option for Faron, please see our earlier report here.

Independent Financing

By self-funding the Phase III study, at least to some extent, Faron would retain the valuable commercial rights for longer. If successful, this could create substantial value for shareholders. The company’s position in partnership negotiations would also be stronger which would support higher royalty rates and milestone payments and help Faron advance its pipeline in other indications more quickly.

Should Faron self-fund the Phase III study, it does not mean that Faron would conduct the study in-house but in collaboration with a contract research organization (CRO). In fact, even if Faron were to partner with a larger pharmaceutical company, the Phase III study would likely at least partly be conducted by a CRO. This underlines that the real value-increasing inflection point with regard to big pharma collaborations is in the marketing and commercialization phase, where the big pharma partner can contribute capabilities that cannot be bought elsewhere.

Conducting a large Phase III study is nonetheless highly expensive. Funding required through the Phase III interim readout is likely between €50 million and €100 million. The absolute amount of equity and debt financing could be lower if a partner is secured before the interim readout. Additionally, it is worth noting that the FDA does not require the study to be fully funded upfront. It requires only that adequate resources are available to conduct it.

Faron has already secured €18.5 million in funds from Heights Capital Management (HCM) in the form of convertibles that are yet to be drawn. For more information about the convertible bond agreement, please refer to our earlier issue here. In addition to the HCM funding, Faron would need to seek equity investments from institutional investors around the globe and possibly from retail investors in Finland and in the United Kingdom.

AGM’s Authorization To Issue Shares

Faron’s Annual General Meeting (AGM), held in March, authorized the company to issue up to 30 million new shares.

Articles of Association

Faron’s articles of association state with regard to deviation from the pre-emptive rights of the shareholders:

If the Board of Directors proposes that the General Meeting of shareholders makes a resolution on a share issue or issue of option rights or special rights entitling to Shares in deviation from the shareholders’ pre-emptive rights or on a share issue authorisation that does not exclude the right of the Board of Directors to resolve on a share issue in deviation from the shareholders’ pre-emptive rights, such resolution shall be made by a qualified majority of three quarters (3/4) of the shares represented and votes cast at the General Meeting of shareholders.

The authorization was approved by a three-quarters majority, which enables the company to use the authorization in connection with a share issue.

Traditional Rights Issue Not Feasible

Faron is listed on First North Helsinki and on the AIM market in London. Because of the dual listing, a rights issue would be difficult, time-consuming and costly. After Brexit, a rights issue would also require separate regulatory approvals in both markets. This does not make a rights issue impossible, but, in our view, it is unlikely given the range of other feasible alternatives.

First Tranche Payments

Faron issued 5 million treasury shares after the convertible bond agreement. The shares are intended to settle HCM bond conversions. The issuance occurred only after the HCM convertible bond announcement. As a result, the first scheduled amortization fell due before the newly issued treasury shares could be registered. The first payment therefore had to be settled by issuing new shares instead of using the treasury shares.

The second payment due in August was settled in cash. The first transactions that affected the treasury share balance were the two advance payments that were settled in shares. These advance payments, together with six days of interest, totaled €1,682,067 which corresponded to 857,322 shares. After these payments, the company held 4,142,678 treasury shares.

Scheduled payments up to and including April 2, 2026, amount to approximately €3.8 million. If the existing share issue authorization is assumed to be allocated to the share offering and other measures discussed later, additional treasury shares would be issued only after the 2026 AGM. If no treasury shares are needed for other purposes before the 2026 AGM, if all scheduled payments are settled in shares, and if none are brought forward, the current treasury share balance should be sufficient to cover the loan costs until that time. More specifically, the treasury share balance would become insufficient only if the weighted average share price applied to these settlements were to fall below €1.03. If that were to occur, additional shares could be issued provided some authorization remains available, which would involve only modest extra regulatory work.

Potential Capital Raise Structures

Given the high costs of extensive Phase III studies, it is highly likely that HCM bonds will play a role in a potential capital raise. This section focuses exclusively on the scenario in which Faron opts to self-fund the Phase III study to at least some extent.

Second Tranche Bond

The second tranche bond has terms similar to the first tranche bond. It is redeemable until late April 2026.

Effect of the Second Tranche Bond on the Authorization

If Faron issues the second tranche bond either independently to support prolonged partnership discussions or as part of a larger capital raise the remaining authorization to issue new shares would be affected. This would occur because special rights would be issued in accordance with the Finnish Companies Act.

The Special Rights

The special rights are purely technical and exist to meet legal requirements. For that reason, the exact number of special rights attached to the bonds is not fixed.

For the first tranche bonds, a total of 12,000,000 special rights were issued. This equals 80,000 special rights per bond with a principal value of €100,000, which corresponds to a 4 to 5 ratio. If the same approach is applied to the second tranche bonds, a total of 8,000,000 special rights would be required.

The ratio appears conservative and suggests the company sought to ensure that no additional special rights would be needed for the first tranche, even in the event of further dilution. The two payments that were brought forward also reduce total interest expense, which further limits cost and dilution and thus the usage of special rights.

Another possible reason for the 4 to 5 ratio is that the remaining authorization from the 2024 AGM was just over 12,000,000 shares. The 2024 AGM granted two authorizations, one intended for the share issue and another for general purposes (including directed share issues such as special rights), similar to the 2025 authorization. The authorization covered 20,000,000 shares, of which 886,504 were issued in connection with a previous funding arrangement (IPF loan) and 6,976,744 were issued in the oversubscribed private placement in early 2025. Thus, 12,136,752 shares remained available under the authorization. The authorization would in any case have expired on June 30, 2025.

Conversion Price

The conversion price is adjusted if dilution occurs. The magnitude of any adjustment is expected to be modest because dilution would be limited given the current market capitalization. In practice, the conversion price is most relevant if Faron is acquired or enters into a lucrative partnership. Under the self-funding scenario outlined here the conversion price is not a significant factor.

The Cost of the Second Tranche Bond

If the second tranche bond is issued in connection with an equity raise, a portion of the authorization would be needed to settle conversions of the convertibles. The total amount depends on the exact timing of the second tranche issuance. Additional treasury shares would likely need to be issued to satisfy conversions before the 2026 AGM.

Depending on timing, there could be up to four scheduled payments before the end of April 2026. The nominal amount of these first four payments, including interest, is approximately €2,600,000. When settled in shares at a 10 percent discount this corresponds to about €2,900,000. The number of shares required to settle these conversions would exceed 2,000,000 only if the weighted average price used for calculating the discount is below €1.45.

In conclusion, issuing a further two million shares on top of the remaining 4,142,678 treasury shares (as of writing) should be sufficient to cover share settlements until additional authorizations are obtained.

Equity Headroom

Assuming the scenario outlined above, where the existing authorization is allocated as previously described for the second tranche bonds and related settlements, approximately 15,000,000 shares would remain available for issuance. This figure follows the earlier assumptions and reasoning on authorization usage, treasury share needs and timing in relation to the 2026 AGM.

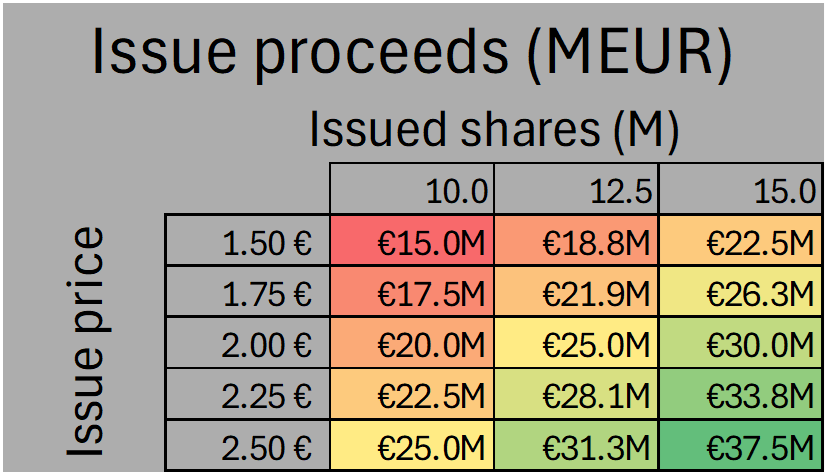

Directed Issue

A directed issue of up to 15,000,000 shares would result in gross proceeds of €22.5 million to €37.5 million, assuming an issue price between €1.50 and €2.50. When combined with proceeds from the second and third tranche HCM bonds, total gross proceeds in this scenario would range from €41 million to €56 million.

Availability of such funding at the indicated valuations is uncertain. For it to be achievable, new large investors should participate as anchors and commit to meaningful allocations. In practice, this would require cornerstone orders that cover a significant share of the book and pricing that holds within the range of €1.50 to €2.50. Without new anchor demand, the terms might need to be adjusted or a broader public offer considered. The strong clinical results improve the prospects of attracting these investors, although the outcome will still depend on market conditions and on the credibility of the Phase III plan and timeline.

Public Share Issue

A public share issue would be detrimental to existing investors because the share price would likely move close to the offer price. Transaction costs would also be significantly higher. After the strong clinical results, the likelihood of this unfavorable outcome has arguably decreased. If Faron fails to attract a big pharma partner and to secure sizable equity investments, a public share issue could remain the only option.

Rights Issue

A rights issue is unlikely for the reasons set out above. Nonetheless, it remains possible, since there is now more time to prepare than last year. In theory a rights issue is preferable to a public offer because total shareholder value should remain unchanged. Value shifts from the share price to the tradable subscription rights, which can be sold or exercised to subscribe for new shares. In practice, however, the share price often trends toward the subscription price, especially when full subscription is uncertain or when overallotment options are available.

Extraordinary Meeting

If Faron proceeds with a large-scale share offering exceeding 15 million shares, an extraordinary general meeting would likely be required to approve additional share issuance. Additional authorizations could be sought in other cases as well, although the company has historically operated under authorizations granted by AGMs. To conclude, directed issues are expected to fit within the existing framework, while larger offerings, whether rights issues or public offers, would require further authorization.

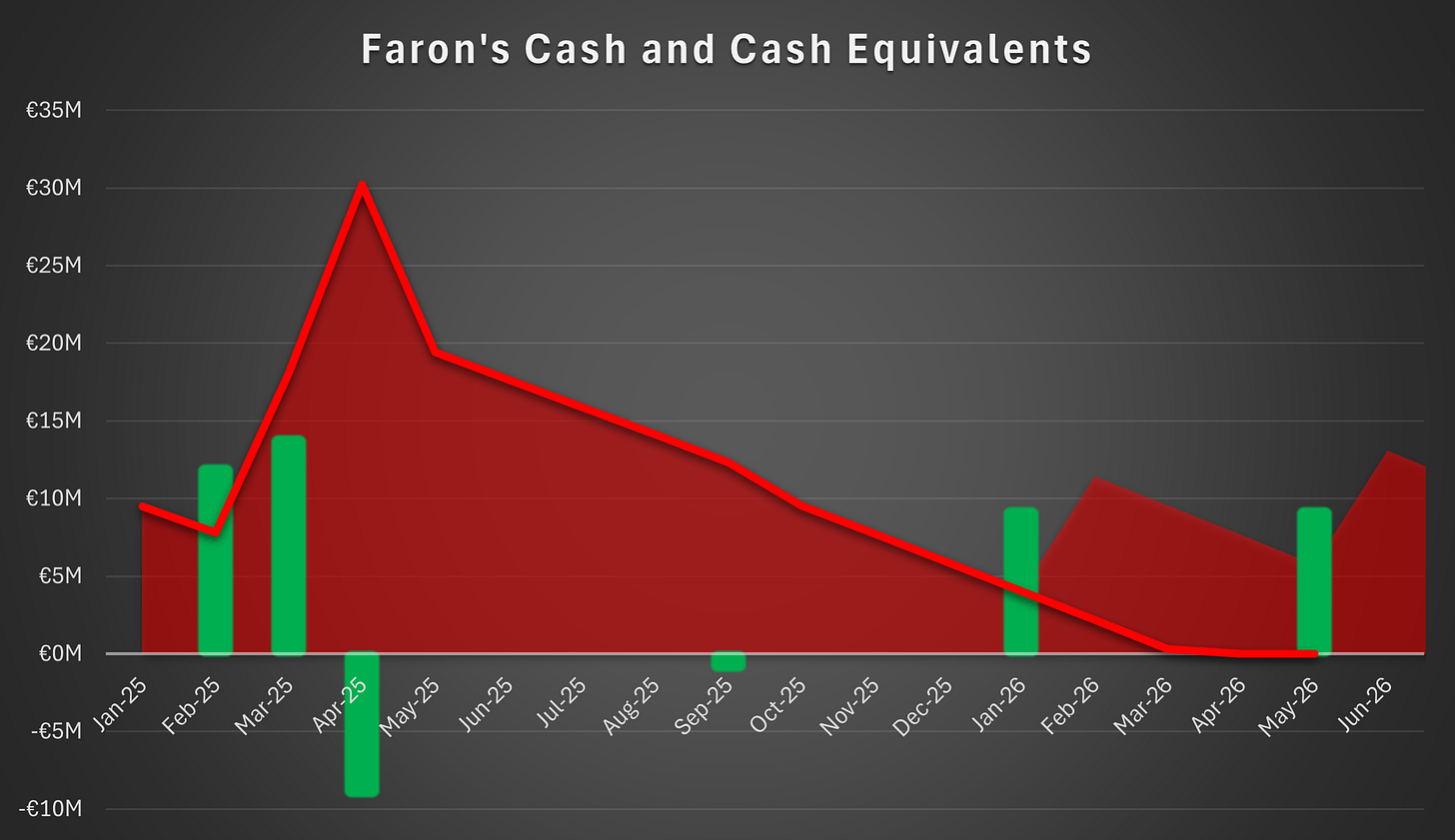

Cash Balance

Faron will publish its H1 2025 report next week. The report will provide a clearer view of the company’s cash position. The only notable change to our cash balance expectation relates to the cash payment made toward the scheduled August installment of the HCM bond. The payment was approximately €1 million and, at the current burn rate, reduced the runway by less than a month.

The cash payment was interpreted as a sign that non-dilutive funding could be secured through a partnership with an upfront payment. Soon after that payment, HCM brought forward two additional installments totaling €1,682,067. Faron chose to settle these in shares at a subscription price of €1.96, which was a 10 percent discount to €2.18. If there had been firm confidence that a partnership with substantial upfront proceeds would be signed by year-end, there would have been little reason to convert the brought forward installments into shares. This sequence suggests the initial cash payment may have been a bluff intended to project confidence to the market and lift the valuation to limit dilution. HCM effectively called that bluff by advancing two installments that were then not settled in cash, since paying in cash would have shortened the runway by roughly one month.

If you are interested in biotech, you may like our earlier article where we derived market expectations for a Swedish biotech company called Diamyd using a martingale-based option pricing framework.

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance.

Pharma stocks are dangerous