Faron Pharmaceuticals - Transforming Value From Shareholders to HCM

Faron’s questionable financing strategy with HCM shifts value away from shareholders and toward debt‐holders, raising critical questions about dilution and long‐term upside.

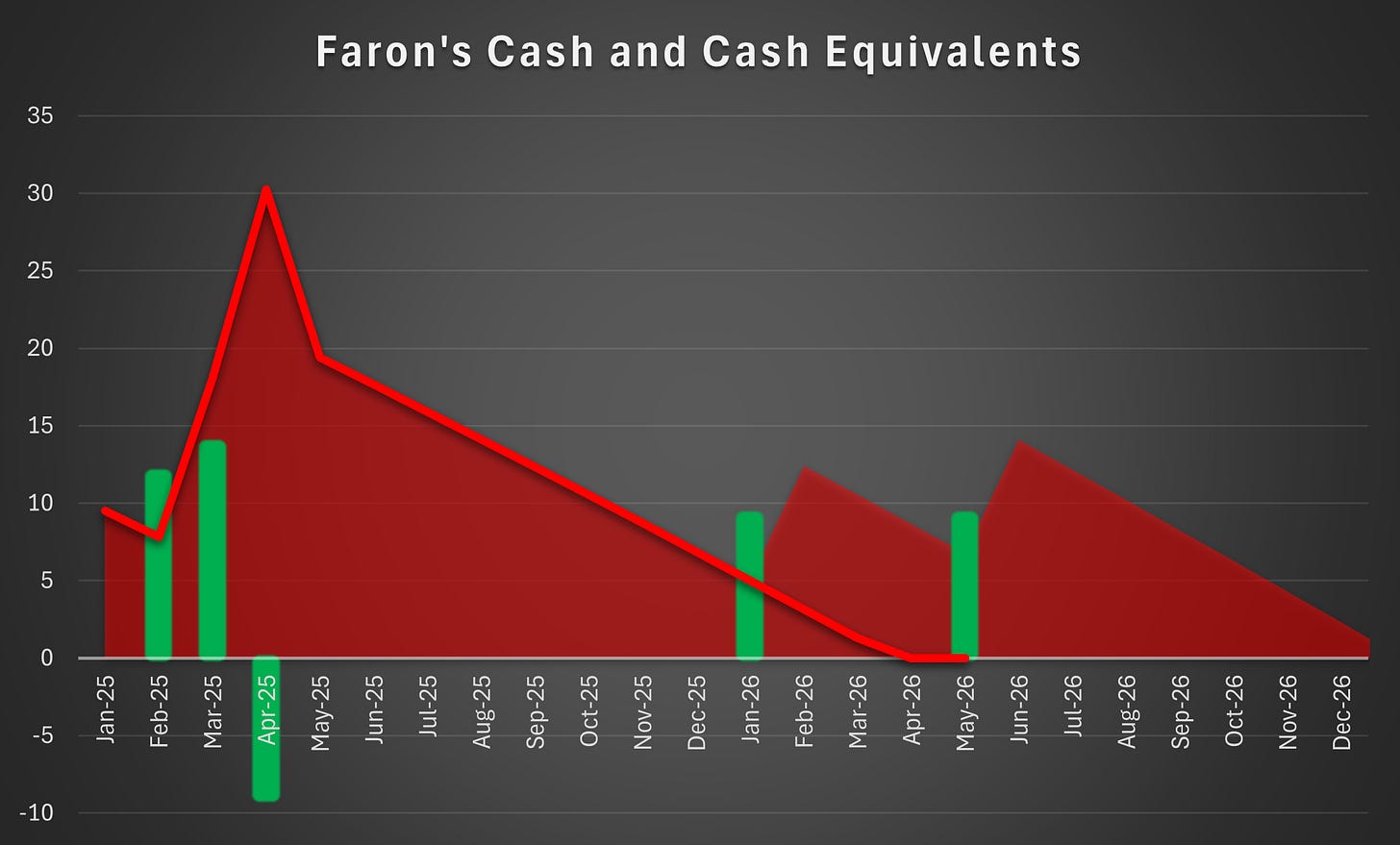

Faron’s existing cash resources are sufficient to fund operations through Q1 2026. As of the end of H1 2025, the company’s cash position stood at just over €15 million—enough to fund the company for approximately nine months. The precise figures will be disclosed when Faron publishes its H1 2025 results in August. In the meantime, it is essential for the company to pursue financing opportunities promptly to minimize the risk of resorting to disadvantageous arrangements.

Operational expenses are expected to continue rising, as the BEXMAB study remains ongoing until the latter half of H1 2026. The company has also continued to recruit professionals, most notably appointing Ralph Hughes as its new Chief Business Officer.

The Convertible Bonds Arrengement - Expensive Funding

In April 2025, Faron announced that it had entered into a convertible bonds arrangement with Heights Capital Management (HCM), the direct investment arm of Susquehanna International Group. Hereafter, HCM and other Susquehanna‑affiliated entities will be collectively referred to as “HCM.”

Background

Two months prior to the bond arrangement, Faron raised €12 million in an oversubscribed placing at just a 10,3 % discount to the previous day’s closing price, corresponding to a share price of €1,72. Before the placing, Faron’s cash reserves stood at just under €10 million, making the capital raise essential to fund the company through its upcoming top‑line readout.

The modest discount underscored Faron’s ability to attract significant financing with minimal dilution—a notable strength in today’s challenging biotech funding environment.

Issuance of First Tranche HCM Bonds

Only two months after the placing, Faron announced that it had entered into a convertible bond agreement and issued the first tranche, raising €13,875 million. The majority of the proceeds were used to repay a loan to IPF. The repayment, including early‐repayment fees, amounted to €9,1 million, thus extending the financial runway by only a few months.

Faron CEO Dr. Jalkanen commented on the arragmented, stating that foreign specialist investors are interested on the company with a grand vision and substantial invesment. Let’s review the terms of the arrangement to assess the accuracy of these statements.

The Terms of First Tranche Bond

Here are the key parameters of the first tranche bond:

Size: €15 million principal, issued at 92,5 % of par

Maturity: 2 April 2028 (three-year tenor)

Coupon: 7,5 % p.a.

Amortization: 18 equal instalments, beginning on June 2th 2025

Conversion price: €2,94 (20% premium)

Settlement: Cash or shares at 90% VWAP

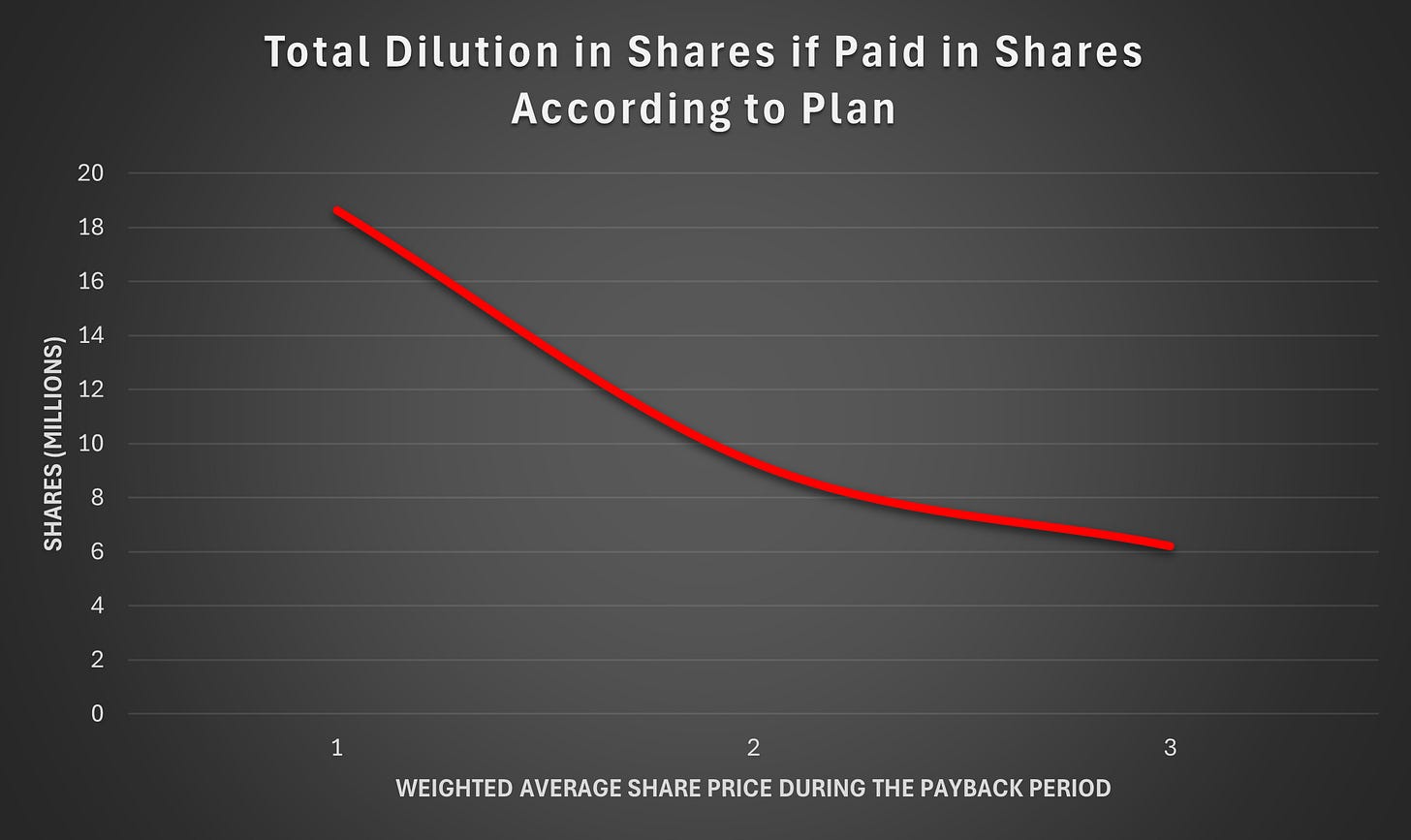

Thus, at least 5,7 million shares is needed to pay back the bond if not converted. With weighted average share price of €2,50, the dilution effect would amount to 7,5 million shares, corresponding to a dilution of approximately 6,3 %.

Comparable Arrangements by HCM

HCM has funded numerous companies with similar vehicles priorly. Here are other arrengements to better understand Faron’s deal.

The majority of these deals have used the same basic structure, consisting of equal instalments—either in cash or shares—every two months.

1. Idex biometric

Norwegian biometric-sensor maker pursuing fingerprint cards for payments.

Size: NOK100 million principal, issued at 92 % of par

Maturity: 3,5 years

Coupon: 6 % p.a.

Conversion price: 25% premium

Settlement: Cash or shares at 90% VWAP

When: December 2023

2. Xbrane Biopharma

Stockholm‑based Xbrane produces low‑cost biosimilars; its first product, Ximlucy® (ranibizumab), is EU‑approved and awaiting FDA decision.

Size: SEK250 million principal, issued at 90 % of par

Maturity: 4 years

Coupon: 6 % p.a. (lowered to 0% upon FDA approval)

Conversion price: 25% premium

Settlement: Cash or shares at 90% VWAP

When: May 2023

3. Crossject

Crossject’s handheld ZENEO® devices deliver emergency drugs (e.g., midazolam for seizures) without needles.

Size: €7 million principal, issued at 90 % of par

Maturity: 3 years

Coupon: 7 % p.a.

Conversion price: 35% premium (with floor)

Settlement: Cash or shares at 85% VWAP

When: February 2024

4. Gensight Biologics

GenSight is trying to commercialise Lumevoq® for Leber hereditary optic neuropathy.

Size: €12 million principal, issued at 90 % of par

Maturity: 5 years

Coupon: 0 % p.a.

Conversion price: 30% premium

Settlement: Cash at 110% or shares at 90% VWAP

When: December 2022

5. Imugene

Sydney‑listed Imugene runs several Phase II oncology programmes (onCARlytics, VAXINIA, HER‑Vaxx).

Size: A$20 million principal, issued at par

Maturity: no fixed schedule

Coupon: 0 % p.a.

Conversion price: 25% premium

When: December 2024

6. Renalytix

US/UK AI-based kidney-risk diagnostics company.

Size: $21,2 million principal, issued at 85 % of par

Maturity: 5 years

Coupon: 5,5 % p.a.

Conversion price: 20% premium (with floor)

Settlement: Cash or shares at 85% VWAP

When: March 2022

7. Abivax

Abivax is developing obefazimod, an oral miR‑124 modulator, for ulcerative colitis and Crohn’s disease.

Size: €35 million principal, issued at par

Maturity: 4 years

Coupon: 6 % p.a.

Conversion price: 30% premium

Settlement: Cash or shares at 90% VWAP

When: August 2023

Faron’s Deal in Comparison

The interest rate for Faron is among the highest in the group. This is despite ECB’s interest rate being lowest since December 2022.

Similarly, the conversion price implies only 20 % premium—on par with the weakest in the group. The conversion price is arguably the most critical parameter, as it materially affects shareholder upside in a positive scenario.

Stock performances since HCM deal

1. Idex biometrics

Stock price, prior to announcement, on 22.12.2023: 146,34

Stock price on 22.7.2025: 3,33

Return since HCM deal: -97,72%

Annualized return: -90,83%

2. Xbrane Biopharma

Stock price, prior to announcement, on 19.05.2023: 45,84

Stock price on 22.7.2025: 0,29

Return since HCM deal: -99,37%

Annualized return: -90,22%

3. Crossject

Stock price, prior to announcement, on 26.02.2024: 4,14

Stock price on 22.7.2025: 1,60

Return since HCM deal: -61,35%

Annualized return: -49,22%

4. Gensight Biologics

Stock price, prior to announcement, on 22.12.2022: 3,41

Stock price on 22.7.2025: 0,13

Return since HCM deal: -96,19%

Annualized return: -71,76%

5. Imugene

Stock price, prior to announcement, on 28.01.2025: 1,33

Stock price on 22.7.2025: 0,32

Return since HCM deal: -75,94%

Annualized return: -94,88

6. Renalytix

Stock price, prior to announcement, on 30.03.2022: 270,00

Stock price on 22.7.2025: 7,25

Return since HCM deal: -97,31%

Annualized return: -66,42%

7. Abivax

Stock price, prior to announcement, on 18.08.2023: 17,10

Stock price on 22.7.2025: 8,90

Return since HCM deal: -47,95%

Annualized return: -28,72%

Bonus: Faron Pharmaceuticals

Stock price, prior to announcement, on 02.04.2025: 2,73

Stock price on 22.7.2025: 2,32

Return since HCM deal: -15 %

Annualized return: -41,4 %

Conclusion:

Average return: -82,3%

Average annulized return: -70,29%

Median annualized return: 71,76%

HCM offers predatory loan arragments that make creating shareholder value extremely difficult. The dilution can quickly trigger a downward spiral—diluting existing shareholders further and putting additional pressure on the share price as HCM liquidates newly issued shares. Correspondingly, Faron’s share price experienced an initial negative reaction of –9 % on the day the arrangement was published and has since followed a similar trajectory to its peers.

Dr. Jalkanen described HCM as foreign specialist investors who invested in Faron with high conviction and major weight. However, given HCM’s track record, the firm has not spotted nor targeted future prospects. HCM’s playbook appears to center on targeting distressed companies that struggle to secure external funding and are consequently forced into bond arrangements with highly unfavorable terms for shareholders.

It’s worth noting that the biotech sector has endured significant challenges since 2021. Nonetheless, the outcomes for HCM‑backed financings remain markedly worse than the broader industry over the same period.

Does HCM Go Down alongside Other Shareholders?

Although shareholders have endured significant losses in the peer group, HCM emerges largely unscathed. The bond arrangements are structured to protect HCM: in Faron’s case, HCM may accelerate up to two payments, with up to nine payments during the first year. If a negative event threatens Faron’s ability to raise fresh capital, HCM can secure its investment before the situation worsens. Moreover, when repayment is made in shares, those shares are issued at a 10 % discount—enabling HCM to liquidate at or above the instalment value even in challenging market conditions.

Why Did Faron Enter into Such an Unfavorable Agreement?

Just two months earlier, Faron had raised approximately €12 million in gross proceeds through a significantly oversubscribed placing at only a 10,3 % discount to the previous day’s closing price, corresponding to €1,72 per share. The transaction is highly comparable to the first‑tranche bond, which generated €13,875 million in proceeds, only 15 % more.

Comparing the First Tranche Bond to a Directed Issue

Had the €13,875 million been raised via a directed issue at the same 10,3 % discount, it would have implied a subscription price of €2,45 and the issuance of approximately 5,66 million new shares. Such predictable dilution would have been particularly valuable, given how costly the bond arrangements have proven to be for peer companies in terms of shareholder dilution.

The total cost of the first‑tranche bond amounts to €16,781 million. To match that dilution if settled in shares, the weighted‑average share price over the payback period would need to be €3,33. Immediate conversion at the €2,94 strike would generate approximately 5,10 million new shares. However, if the share price remained at €2,30 throughout the payback period, dilution would rise to about 8,11 million shares—43 % more than comparable directed issue.

The dilution has no upper limit. The company could opt to make payments in cash if the share price is unfavorable. However, this doesn’t solve the problem, as the company is dependent on external funding, the cost of which in dilution terms depends on the share price.

Could a Directed Share Issue Have Been Possible?

The earlier directed share issue was executed at a considerably lower valuation. Does this imply that investors were no longer willing to fund the company at a higher valuation, or was a second directed issue just two months later neither financially nor allocation‑wise feasible? Alternatively, would two such placings in quick succession have been perceived negatively? In any case, bringing in external, non‑strategic investors immediately before pursuing a transformative partnership raises valid questions.

The Possibility for Further Funding

At first glance, it might appear that Faron entered into the HCM agreement primarily to secure subsequent bond financings, thereby creating a continuous funding runway, reducing uncertainty, and supporting the share price. However, the need to issue the second‑tranche bond actually signals a negative outcome rather than stability.

Further Funding

If a partnership deal is within reach, an agreement is likely to materialize only after the study design—and therefore the costs—of the pivotal Phase III trial have been finalized, which would push it into mid‑2026. Alternatively, Faron could elect to self‑fund the Phase III study, a path we believe is feasible. Read more about this possibility in our earlier issue here.

The capital required to extend the financial runway by three to six months is approximately €5 million to €10 million. Visibility into the burn rate and current cash reserves will improve once the company publishes its H1 2025 report in August.

Here are the two main options for the company:

1. Secure More Funding via a Directed Issue

A directed issue would signal confidence from existing shareholders and, in our view, enhance the likelihood of business‑development progress.

2. Issue The Second Tranche Bond

The second‑tranche bond would provide an immediate liquidity infusion of €9,25 million, extending the runway by 5–6 months. However, it imposes highly unfavorable terms on existing shareholders—amplifying those seen in the first tranche. Moreover, once the second tranche is issued, the third tranche effectively becomes a call option for HCM, sidelining existing shareholders.

Terms for Second Tranche Bond

To be eligible for the second‑tranche bond, Faron must satisfy the following conditions:

Phase II topline readout in respect of its BEXMAB r/r MDS Study indicates an objective response rate of at least 60 per cent

The ORR achieved was 63 %, so Faron has met this requirement.

The arithmetic mean of the daily traded value of the Shares on each dealing day comprised in the three-month period preceding the issuance of the Second Tranche Bonds is greater than EUR 500,000

This ensures sufficient market liquidity so that any share‑settled payments can be liquidated promptly. This term will not pose an issue since the stock is highly liquid.

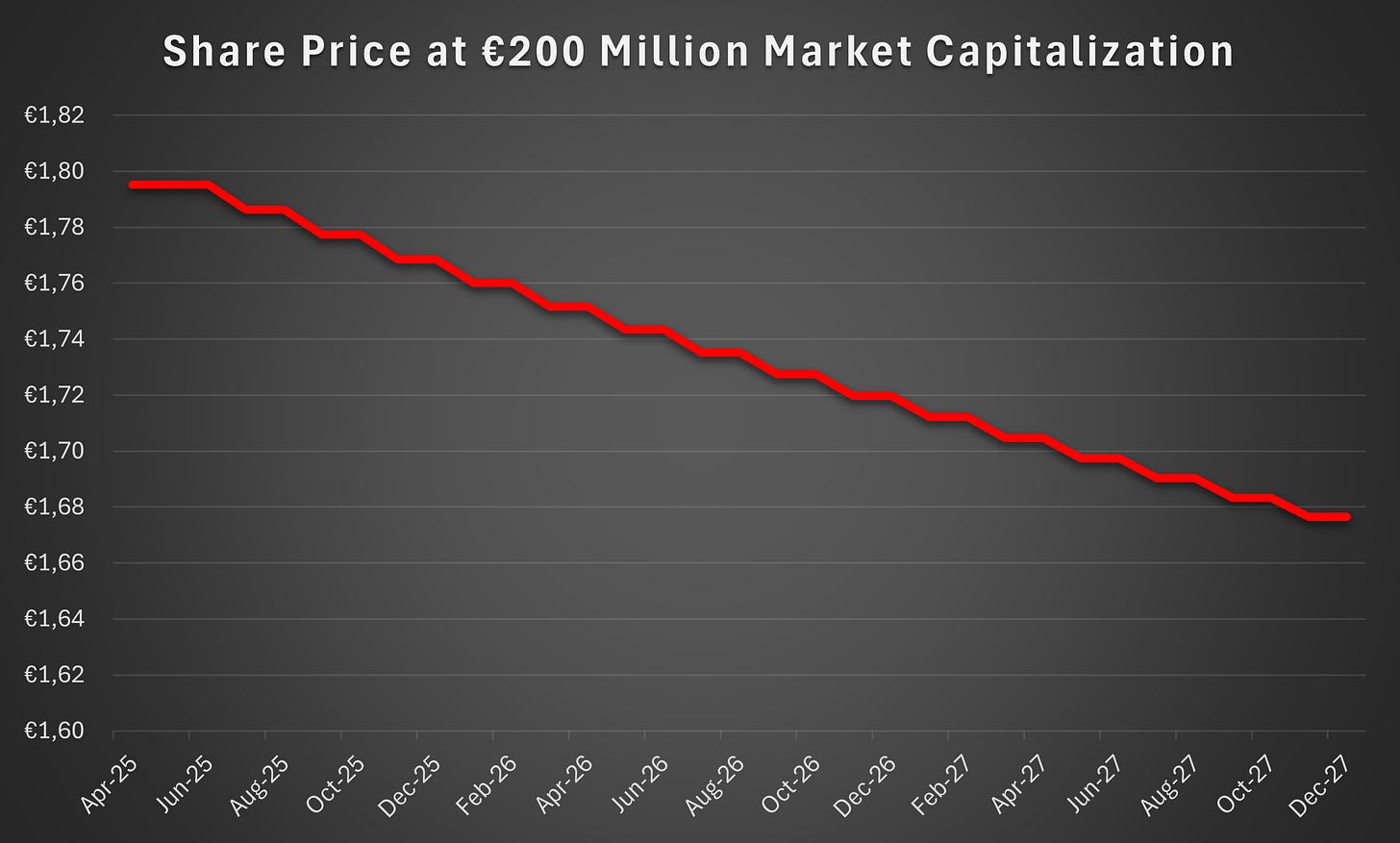

The Company has a market capitalisation greater than EUR 200 million on the date of issuance of the Second Tranche Bonds.

Market capitalization is calculated based on outstanding shares, excluding any treasury shares. Consequently, market cap will rise as the company makes tranche‑related share payments, even if the share price remains constant. To satisfy the €200 million market‑capitalization requirement for a second‑tranche bond issuance in H2 2025, Faron’s share price would need to exceed €1,75.

Possible Overhang Effect

If the issuance of the second‑tranche bonds becomes imminent and the stock trades near the threshold, there is a possibility of an overhang effect on the share price. Uncertainty regarding funding could trigger anxiety among investors until the company secures additional financing. Should the share price fall below the threshold, it could exacerbate downward pressure, as the risk of a financing crisis intensifies when one option appears unavailable.

What Happens If Faron Is Not Eligible For the Second Tranche Bond?

In that scenario, HCM would hold all the negotiating power and could demand extra assurances—such as equity investments from other parties. We believe this outcome would significantly increase the likelihood that Faron opts to self‑fund its Phase III study. However, it is also possible for HCM to waive the condition without futher drama.

The Caveat Regarding the Issuance Of The Second Tranche Bond

If Faron issues the second‑tranche bond, HCM would then have the unilateral right to trigger the third‑tranche bond under the agreed terms. The conversion price for the third tranche would be set at a 20 % premium to the lowest daily VWAP over the six trading days preceding issuance. Effectively, this grants HCM a call option exercisable during the 12‑month period starting six months after the second‑tranche issuance. The value of this option is substantial, further constraining upside potential for ordinary shareholders. We will provide a more detailed analysis should Faron proceed with the second‑tranche bond.

Convertibles - Debt in Name Only

As we have seen, the convertibles will result in significant dilution and are highly likely to be settled in shares at a discount, making them essentially equivalent to equity‑based financing arrangements. Therefore, when estimating the company’s per‑share value via discounted cash flow analysis, these convertible bonds should be incorporated by upfronting the dilution. This can be done conservatively by assuming conversion at the current share price. In scenario‑based analyses, more granular assumptions may be applied.

Until the business generates cash flow, cash payments effectively translate into share issuance, since dilution is the only way for the company to raise cash for now. Treating these convertibles as debt in valuation therefore results in per‑share targets that are systematically too high.

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance.

This is a blog. Dont be blinded by the name Rose Garden Capital which could give wrong impression for some readers. Normally namings like that are companies with their own home site and staff with names.

But also opposite wise. Give a change for the content. It is very carefully written. All wordings are carefully considered.