Hims & Hers Health - Generational Opportunity to Destroy Capital

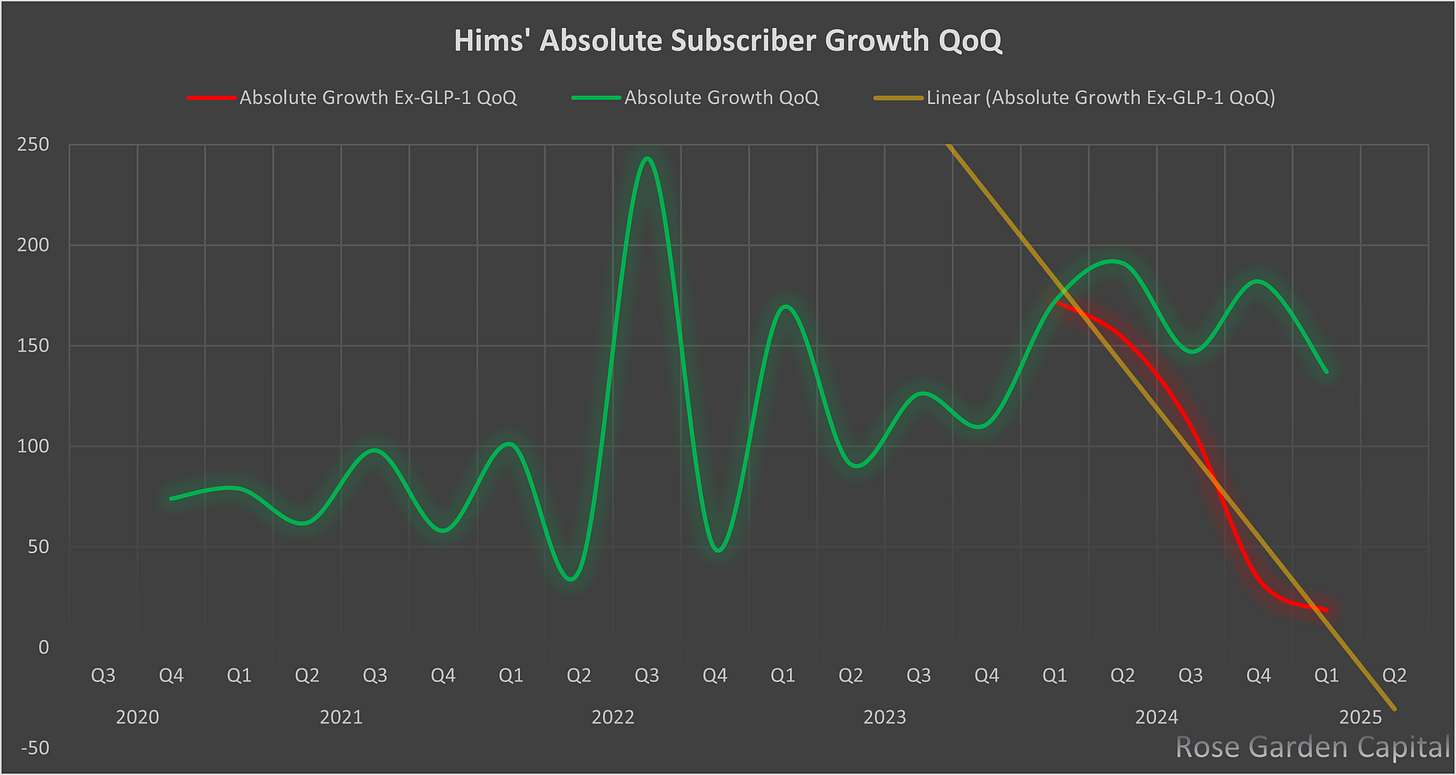

Hims’ core operations may record negative subscriber growth for the first time in its history in Q2 2025. This leaves the company reliant on its GLP-1 segment—and exposed to the risk of legal action.

In this report, we discuss the latest news regarding the dispute with Novo Nordisk. We explore the strategic choices that culminated in the partnership’s premature end, and consider what happens next.

Novo Nordisk News

The decision by Novo Nordisk to terminate its agreement with Hims & Hers took many investors by surprise. However, there were early signs, indicating potential headwinds within the agreement.

Following the deal announcement, Hims launched an intensive campaign for Wegovy that ran for several weeks before the company shifted its focus. On June 9, Hims rolled out a 20 % discount on compounded semaglutide. We’ll explore the strategic rationale behind that promotion in more detail later, but this aggressive push may well have been the final straw prompting Novo Nordisk to terminate the agreement.

The significance of the deal for Hims was never in the sales: Wegovy was never going to contribute more than 1-2 % to Hims’ revenue. The real benefit for Hims was the elimination of the litigation risk. Arguably the chance of Novo suing its long-term partner was 0,00 %.

Novo x Hims Long-term Collaboration

Once the deal was announced, Hims launched a brand new website highlighting the possibilities of long-term collaboration between the companies. Hims bulls envisioned a future where Hims serves as a link between cash-paying customers and Big Pharma. The collaboration was supposed to pave the road for further collaborations with other BP-companies - and it was completely sensible to think so at the time.

In losing Novo as a partner, Hims forfeited far more than a single co-marketing agreement; it effectively closed the door on any comparable partnership in the foreseeable future. Hims also revealed its playbook when it comes to partnerships:

Form a partnership with Big Pharma to distribute branded medicine

Leverage the partner’s intellectual property in marketing

Offer customers legally compounded alternatives at a significantly lower cost.

Gradually cease promotion of the branded product

Use the branded offering as a reference point to highlight cost savings on the compounded version

But what drove management to take this route? When the deal was announced, investors expected that Hims had already agreed to drop compounding in order to secure the deal. The future prospects, elimination of litigation risk and access to Novocare were arguably worth enough to give up most of the compounded GLP-1 revenue which amounted $230 M in Q1 2025. To understand the choice, we first need to examine the state of Hims’ core business before the deal.

Hims’ Revenue - Not a GLP-1 Story?

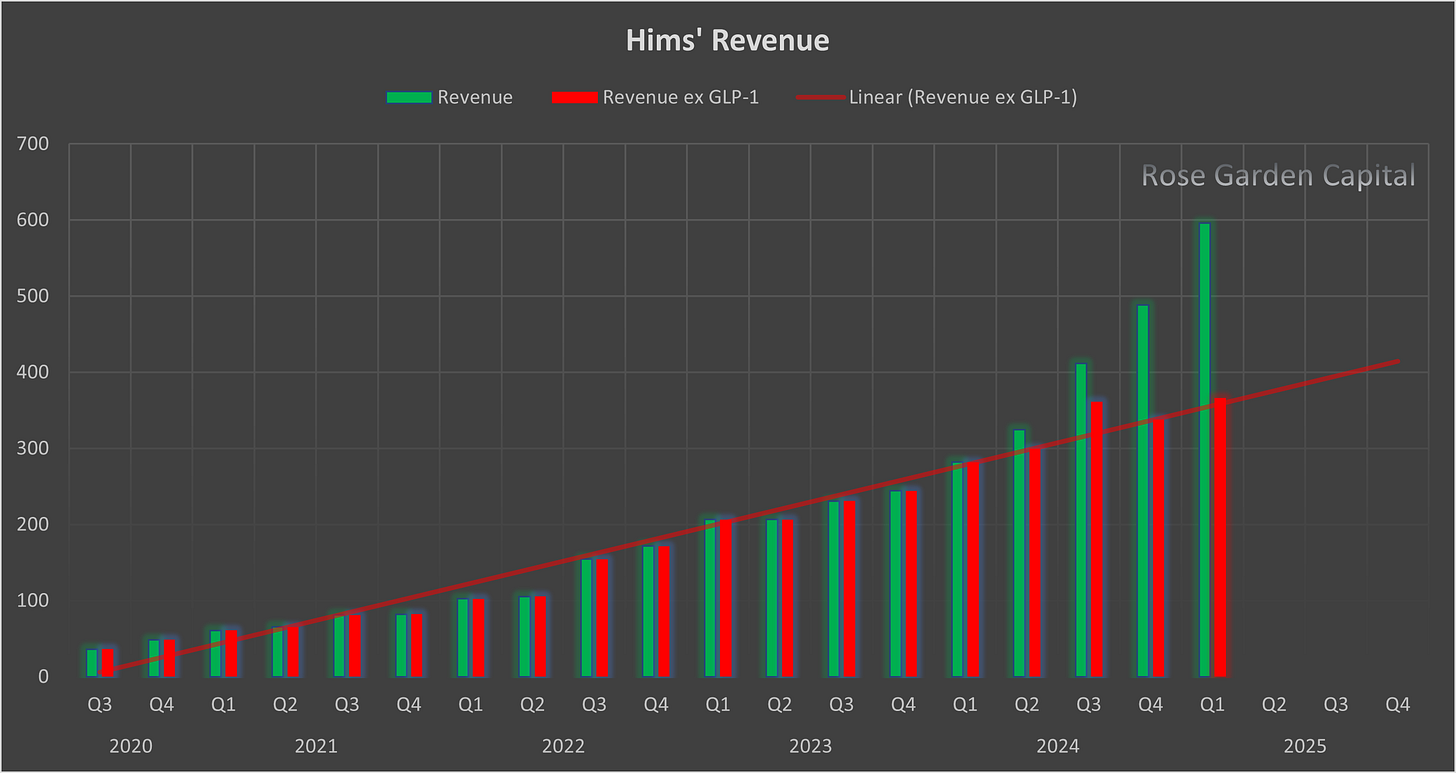

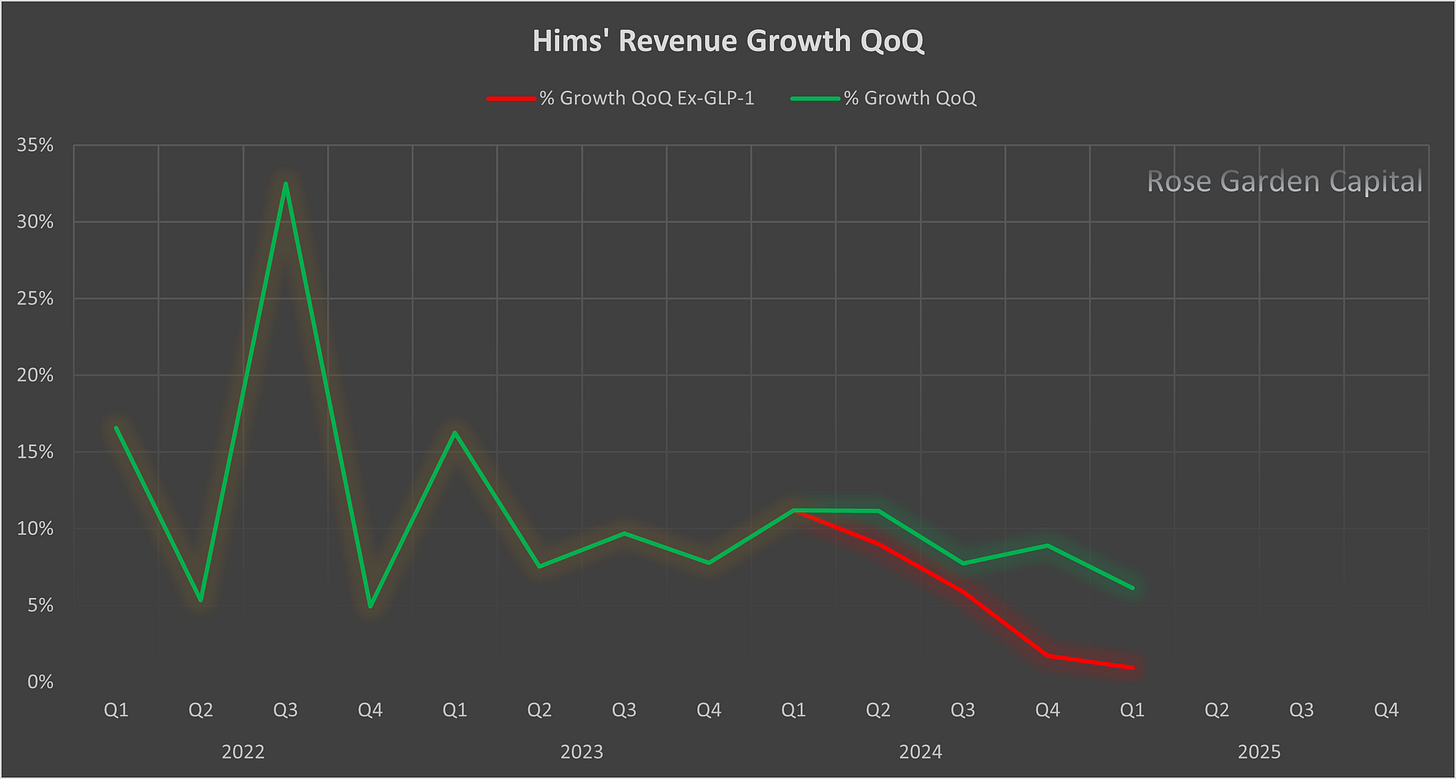

Hims would be barely growing if it wasn’t for GLP-1s.

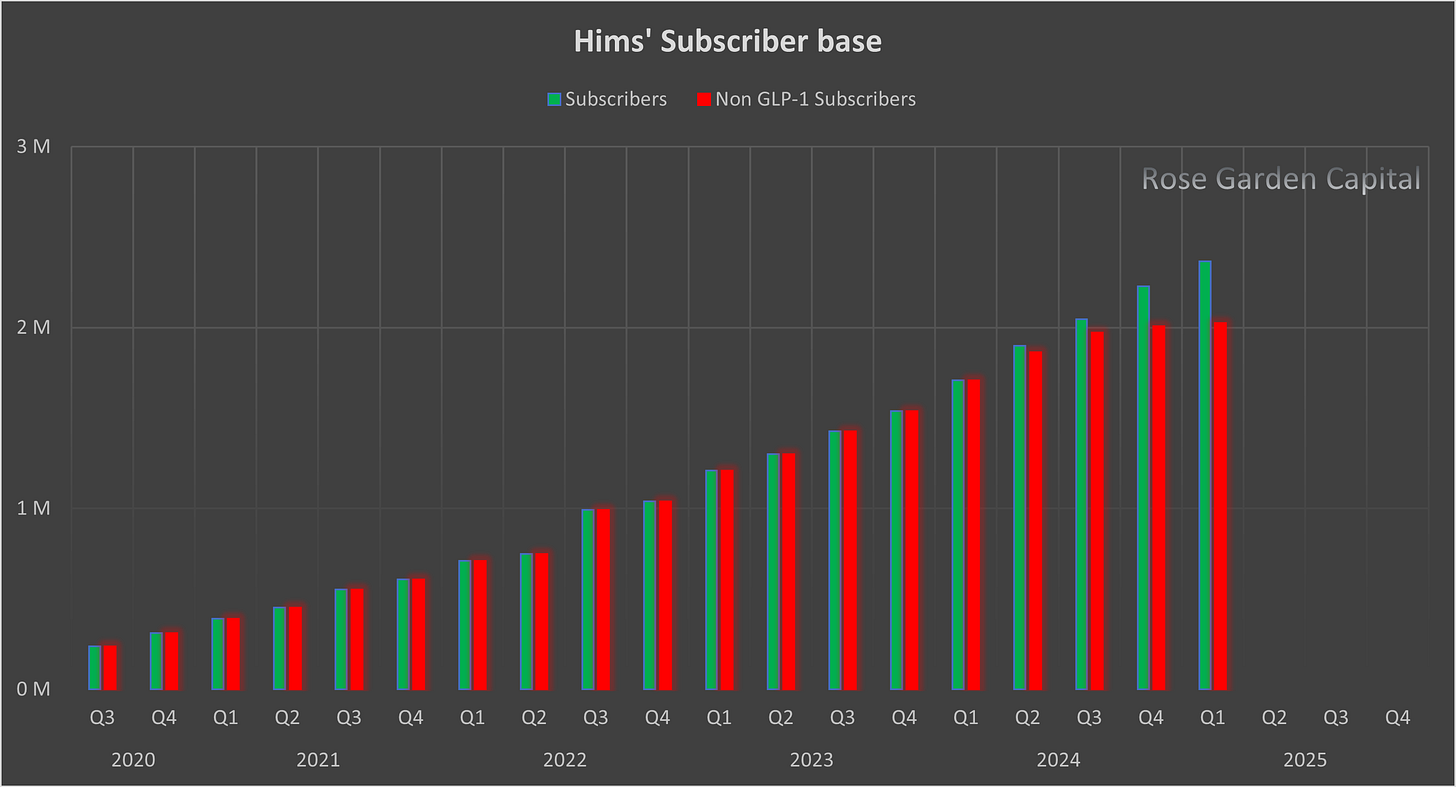

While the subscriber base has grown steadily, the recent spike is almost entirely attributable to GLP-1 uptake. Below are Hims’ GLP-1–related revenue and subscriber figures since the launch in Q2 2024. We assume that the monthly average revenue per user (mARPU) remained constant at $225.

Q2 2024:

GLP-1 revenue: $25 M*

Total revenue: $325 M

Share of GLP-1 revenue: 8 %

Q3 2024:

GLP-1 revenue: $50 M*

Total revenue: $441 M

Share of GLP-1 revenue: 12 %

Q4 2024:

GLP-1 revenue: $150 M*

Total revenue: $488 M

Share of GLP-1 revenue: 31 %

Q1 2025:

GLP-1 revenue: $ 230 M**

Total revenue: $596 M

Share of GLP-1 revenue: 39%

Q2 2025:

GLP-1 revenue: $175 – 198 M***

Total revenue (estimate): $550M (top end of guidance)

Share of GLP-1 revenue: 32 % – 36 %

* Estimate based on the company’s disclosure of $225 M in GLP-1 revenue for FY 2024

** Reported in the Q1 2025 earnings release.

*** Hims reported that a “significant majority” of the $230 million in Q1 2025 GLP-1 revenue derived from “personalized doses”—we estimate this to be in the 66–75 percent range. Furthermore, fueled by an aggressive Q2 marketing push, we project this segment expanded by roughly 15 percent quarter-over-quarter.

At present, GLPs contribute approximately a third of Hims’ revenue.

However, GLP-1 business is the only part that is growing anymore.

Subscriber Base - Flat Without GLP-1s

Similarly to revenue, GLPs have been the only component contributing to subscriber growth. Excluding GLP-1, the subscriber count has remained virtually unchanged since Q3 2024.

However, it’s important to recognize that the subscriber base naturally declines over time due to churn. A relatively high attrition rate is to be expected in this business—patients improve and may no longer require treatment. Although Hims doesn’t disclose its churn metrics, we believe its retention performance is at least on par with, if not superior to, industry peers. Consequently, maintaining a stable subscriber count requires a steady stream of new subscribers.

However, the company is finding this increasingly difficult. Its core business is either losing subscribers or attracting few new subscribers—likely a mixture of both—and as a result, the company is reliant on the GLP-1 business.

Marketing - Just Accelerate Marketing to Keep the Core Growth Afloat?

Hims’ business is all about marketing. Marketing is a true operating expense for Hims since pausing marketing would result in an immediate effect on the subscriber base.

Since the subscriber growth outside of GLPs has been close to flat in recent quarters, one could approximate the minimum marketing spend required to keep the subscriber base flat. We’ll come back to it in upcoming issues.

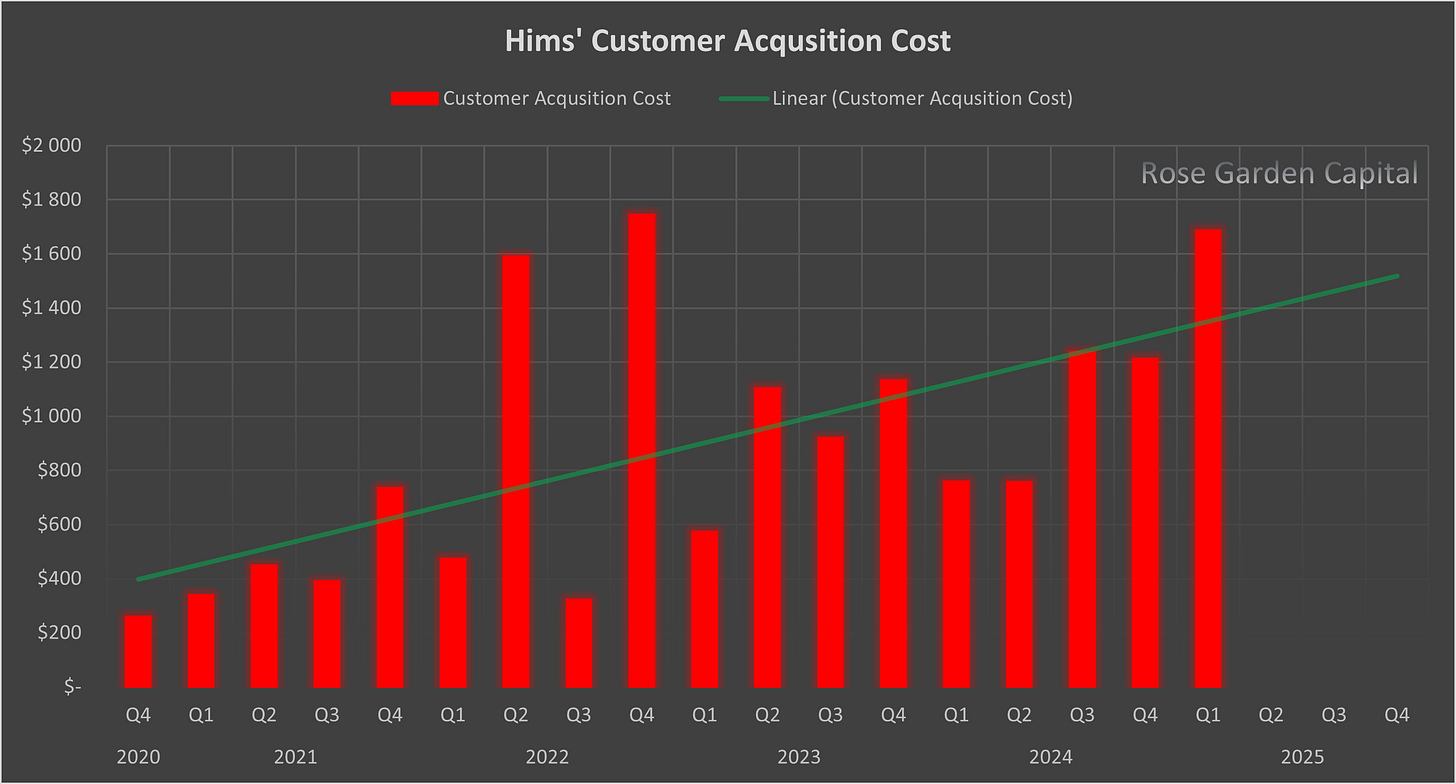

Marketing efficiency is typically assessed via Customer Acquisition Cost (CAC)—total marketing spend divided by the number of new customers acquired. Hims’ CAC has risen steadily over time. That said, because the denominator reflects net subscriber gains (after accounting for churn) rather than gross new sign-ups, the measured CAC overstates the true cost of acquiring each customer.

Improved customer retention helps offset the rising CAC: by delivering tailored, personalized solutions, the company has demonstrably strengthened subscriber retention.

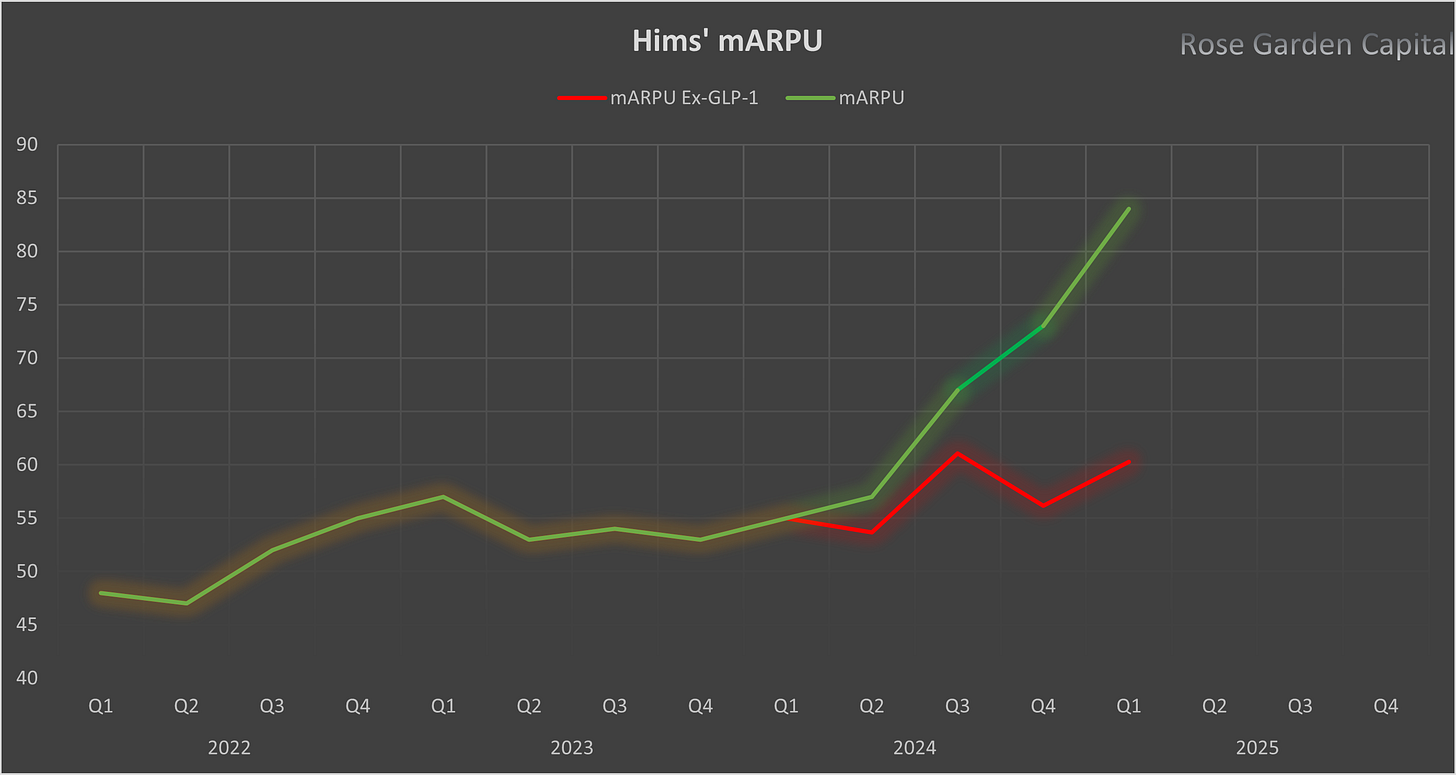

However, far more important has been the increase in monthly Average Revenue Per User driven by compounded semaglutide. Together with their superior margins, GLP-1s represent an exceptionally lucrative segment for Hims, even amid intensifying competition.

As shown above, mARPU has remained relatively flat once the GLP-1 effect is excluded.

Core Business Deceleration’s Impact on the Novo Nordisk Deal

Now that we’ve established the underlying weakness in Hims’ core business, let’s revisit the Novo Nordisk agreement and unpack why management followed the course they did.

Hims entered Q2 2025 and full year 2025 with very ambitious guidance. The Q2 outlook of $530 – $550 million implies robust growth, once you factor in the loss of commercially available doses of semaglutide.

It’s plausible that, at the deal’s inception, management believed branded Wegovy could scale meaningfully on the Hims platform. However, within two weeks they likely recognized its limitations: at $599 per month for a six-month subscription, Wegovy simply couldn’t move at the volume necessary to hit those targets. Faced with underwhelming branded Wegovy sales figures despite heavy marketing support, management appears to have pivoted aggressively toward the only lever still capable of hitting guidance—compounded semaglutide.

Critically, the core business offered no safety net. With non-GLP-1 subscribers flat or contracting, a continued slump there would have dragged overall results into negative territory. Thus, the management was left with a choice: either revise guidance or double down on compounded semaglutide.

Litigation Risk

The decision carries significant litigation risk, as compounding semaglutide at scale may violate regulatory and patent restrictions. No longer confined to exceptional clinical scenarios, personalized doses are now broadly available to practically anyone. Moreover, the company is actively marketing these compounded formulations to individuals with no prior GLP-1 treatment history.

Novo Nordisk has already initiated more than 120 lawsuits against compounders. Hims’ sole potential defense is its emphasis on “personalization,” a rationale that the other compounders cannot invoke.

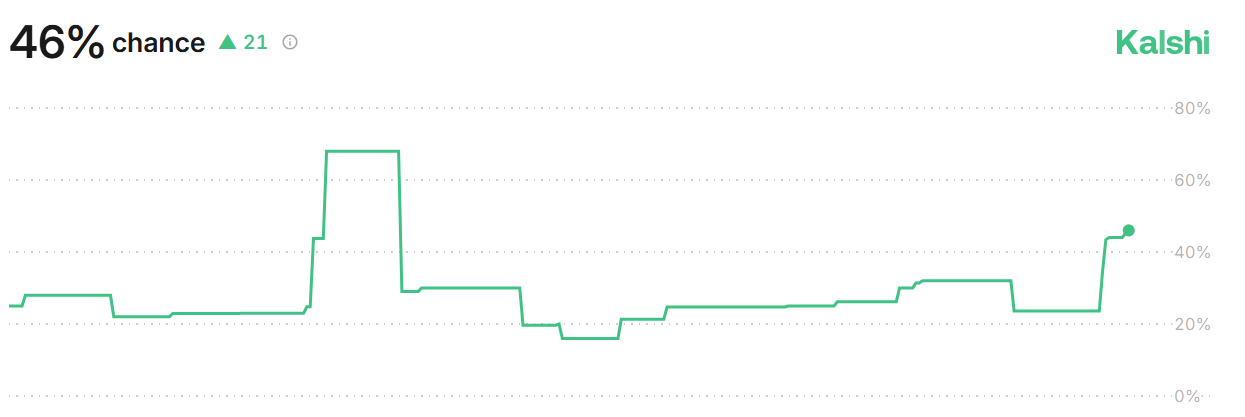

Predicting whether Novo Nordisk will pursue legal action is inherently uncertain. However, as of this report, the Kalshi market implies a roughly 46 % probability that Novo will sue Hims by year-end. While that market is notably illiquid, the signal is unambiguous: Hims faces a meaningful risk of litigation.

What if Novo Does Sue?

If Novo Nordisk initiates legal action, Hims & Hers would incur substantial legal expenses, weighing on its GAAP results for years to come. A victory for Hims would set a dangerous precedent—effectively legitimizing its “personalization” defense as a loophole to circumvent patent and IP protections. Such an outcome could destabilize the pharmaceutical patent framework and likely trigger congressional or regulatory intervention, although Hims would be free to continue compounding semaglutide at scale for at least a while.

Conversely, if Hims loses, it would almost certainly have to abandon its compounded semaglutide business—the one segment fueling recent growth. That scenario could slash revenue by about one-third and drive mARPU down by roughly 35 %. In turn, these impacts would likely push Hims back into negative GAAP free cash flow for FY 2025—and, depending on the timing of any settlement, potentially into FY 2026 as well.

Mitigating the Impact of a Potential Loss

Hims has already faced the threat of losing a large segment of its subscriber base. In May 2025—once the semaglutide shortage ended—Hims was forced to halt sales of commercially available semaglutide dosages.

At that time Hims had several options available to retain the vast majority of the at-risk subscribers by offering:

“Personalized” doses of the same drug

Branded version of the same drug at NovoCare prices (from $599/month)

Generic liraglutide

Oral medications

Most subscribers likely migrated to “personalized” compounded doses, as they could continue using their prepaid commercial supply until it ran out. By allowing customers to accumulate up to a 12-month supply, Hims spread the revenue impact over an extended period—yet this also meant that only a small fraction had the chance to even consider branded Wegovy.

Generic liraglutide offers little appeal to patients, given its requirement for daily injections and premium price point (from $300/month). The drawbacks mean that Hims isn’t able to sell liraglutide at scale.

If Hims were forced to discontinue its “personalized” semaglutide offering, its retention toolkit would narrow to:

“Personalized” doses of the same drugBranded version of the same drug at NovoCare prices (from $599 a month)Generic liraglutide

Oral medications

The only realistic alternative would be oral medications. To secure conversion rates anywhere near those seen with commercially available semaglutide, Hims would need to offer substantial discounts. Even then, it’s unlikely to retain more than a fraction of its estimated 340,000 personalized-dose subscribers as of Q1 2025.

The hit wouldn’t stop there. Since the company spent a significant sum to acquire these customers in the first place, it would mean the GLP-1 marketing budget delivered a negative return on investment. The high CAC isn’t justifiable if there’s even the slightest chance of complete churn among the “personalized” semaglutide subscriber base.

The marketing spend on branded Wegovy likely manifested mainly in “personalized” semaglutide sales, so the contract termination did not have a similar impact.

New Verticals Are Urgently Needed

It’s possible that the current growth hiccup is merely temporary, pending the launch of the new TRT and HRT product lines later this year. For Hims to sustain its growth narrative, these launches must succeed—but their revenue won’t flow through until 2026, meaning they won’t bolster FY 2025 results.

Likewise, the gummies introduced in June represent a solid strategic fit, yet their contribution will be immaterial relative to the company’s broader growth objectives.

In the next part, we’ll explore:

Valuation

Executive compensation

Q2 results

Marketing spend

and much more

Thank you for reading!

If you have any questions or feedback, please feel free to leave a comment below.

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance.

You know just enough about HIMS to reach conclusions, but not enough to know you're reaching the wrong conclusions.

You don't have to make so many assumptions - the company makes enough disclosures and provides enough data for you to be able to back into most of your assumptions.

One example - you reach the conclusions that CAC is the highest it's ever been but retention (on par of better than peers) is helping them.

The exact opposite is true--the cost of acquiring a customer has never been lower (improving brand awareness), but their churn has never been higher.

Back to the drawing board bud., you're close.