Hims & Hers Health – GLP-1 Fuels the Engine While Core Business Stalls

Hims is spending more to grow less, and the growing dependence on compounded semaglutide adds significant legal uncertainty.

In this issue, we take a closer look at Hims’ Q2 2025 financial report. While top-line growth remains strong, a deeper dive reveals growing reliance on GLP-1 sales, softening core metrics, and signs of pressure beneath the surface.

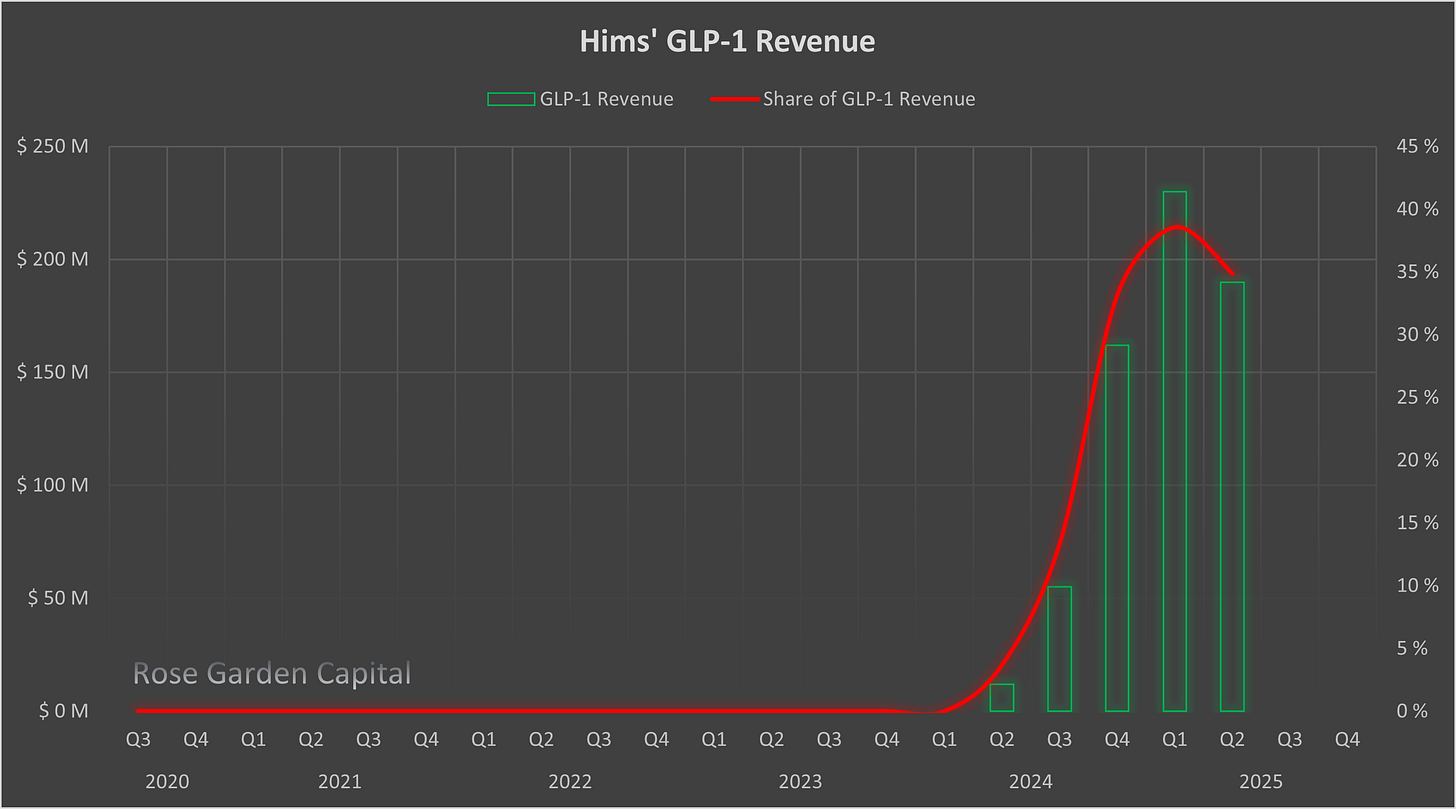

GLP-1 Story Continues

Here are the key figures since Q2 2024:

Q2 2024:

GLP-1 revenue: $12 million

Total revenue: $325 million

Share of GLP-1 revenue: 4 %

Q3 2024:

GLP-1 revenue: $55 million*

Total revenue: $441 million

Share of GLP-1 revenue: 12 %

Q4 2024:

GLP-1 revenue: $162 million*

Total revenue: $488 million

Share of GLP-1 revenue: 33 %

Q1 2025:

GLP-1 revenue: $ 230 million

Total revenue: $596 million

Share of GLP-1 revenue: 39 %

Q2 2025:

GLP-1 revenue: $190 million

Total revenue: $545 million

Share of GLP-1 revenue: 35 %

* Estimate based on the $229M GLP-1 revenue for FY 2024

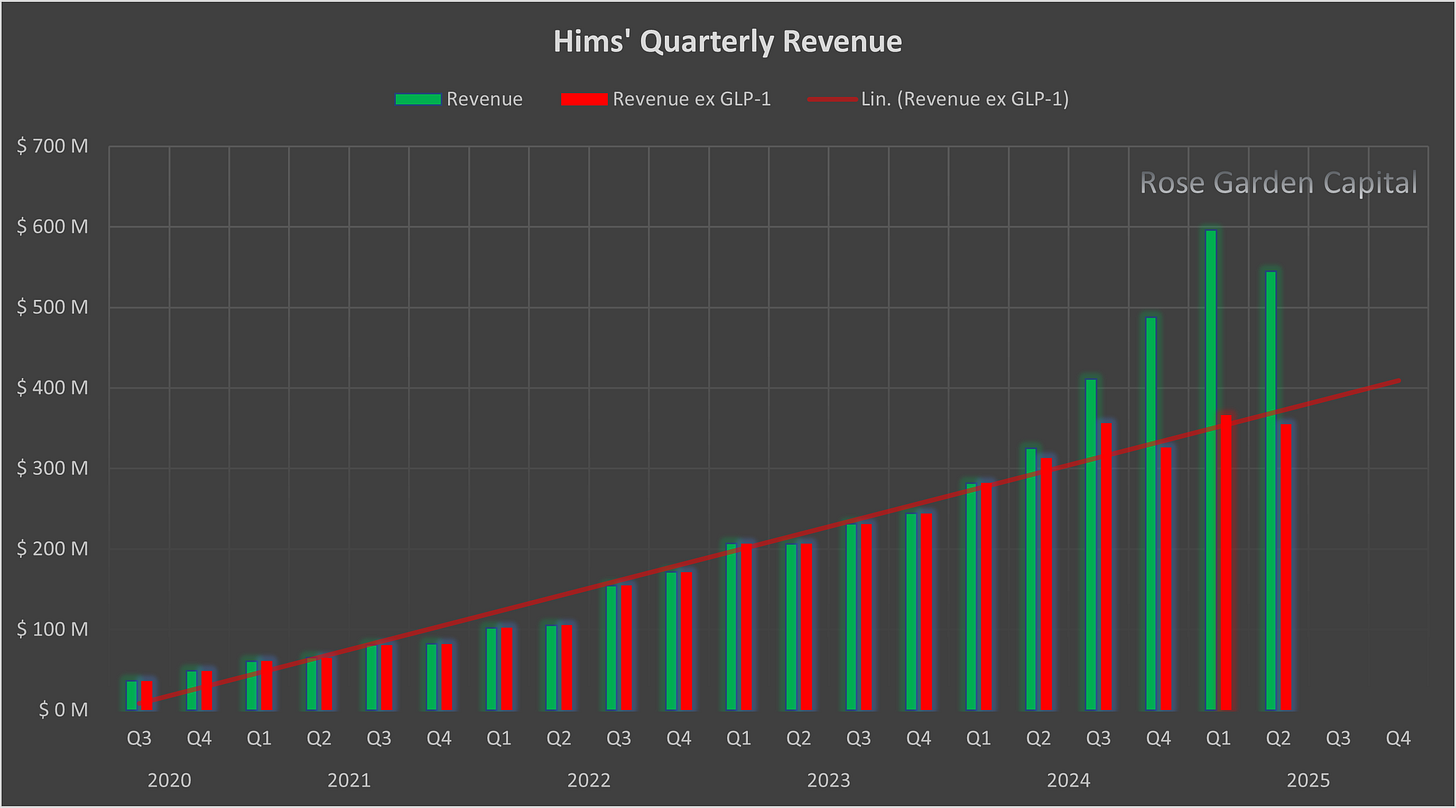

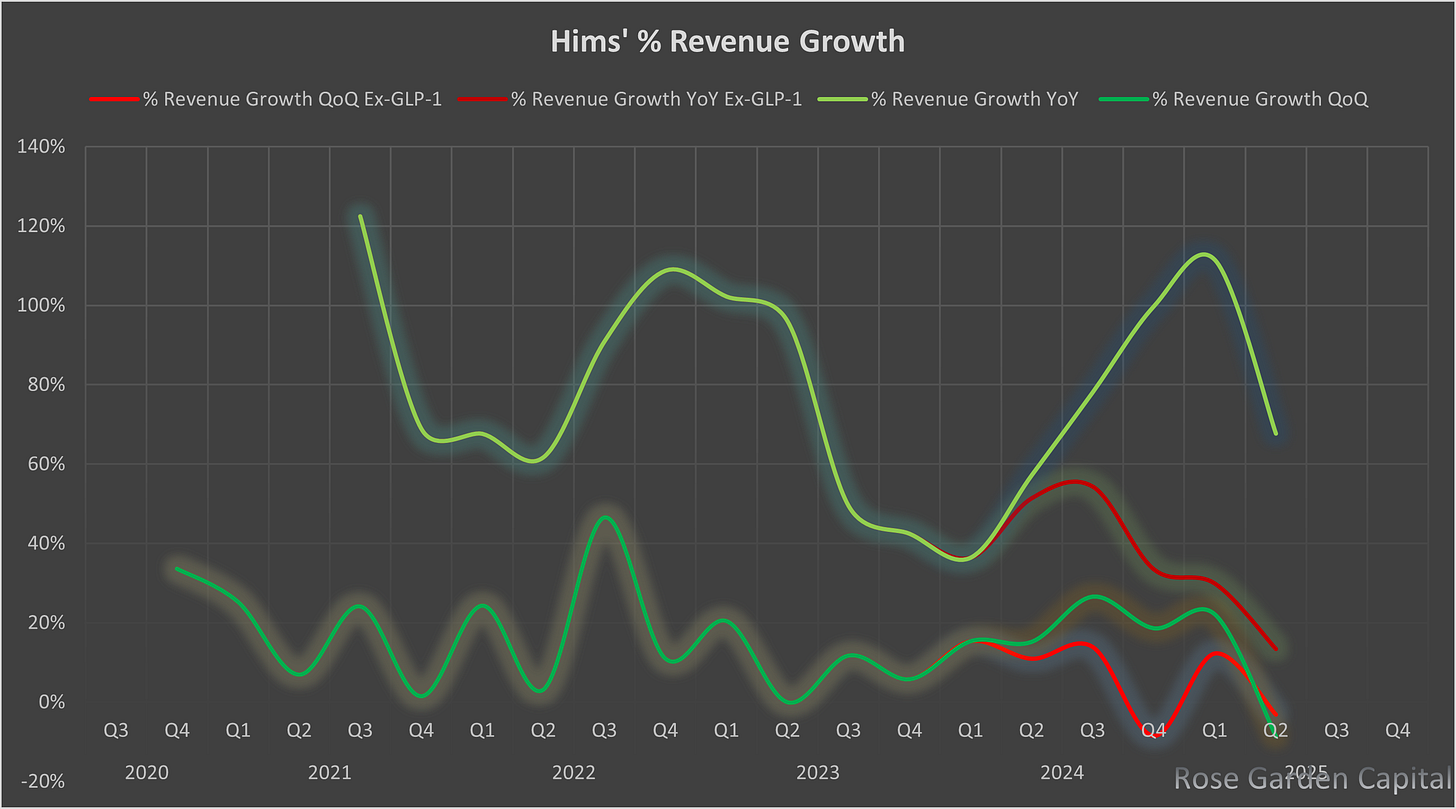

Revenue – Momentum Stalls Amid GLP-1 Reliance

Historically Hims has issued conservative guidance and then surpassed the top end of its range. This quarter, however, reported revenue landed about one per cent below the high end of management’s outlook.

GLP-1 sales reached $190 million, down from $230 million in Q1. The decline reflects the planned phase-out of commercially available semaglutide dosages. Management stated in Q1 that a “significant majority” of GLP-1 revenue came from personalized dosages. Provided that the phrase implies roughly 66–75 %, GLP-1 sales grew 10–25 % quarter-over-quarter in Q2. While many compounders have pulled back in the post-shortage environment, Hims appears to be doing the opposite, thereby strengthening its competitive position and attracting new customers to the platform.

Core revenue is under significantly greater pressure. It grew only 13 per cent year on year, compared with overall top-line growth of 73 per cent. Q2 core revenue of $355 million is virtually unchanged from the $356 million recorded in Q3 2024, underscoring a stagnating underlying business.

Year-on-year comparisons will become more demanding in the second half, because the Q3 2024 and Q4 2024 numbers are the first to include substantial GLP-1 contributions. As those figures roll into the denominator, headline growth rates are likely to decelerate even if absolute GLP-1 sales continue to expand.

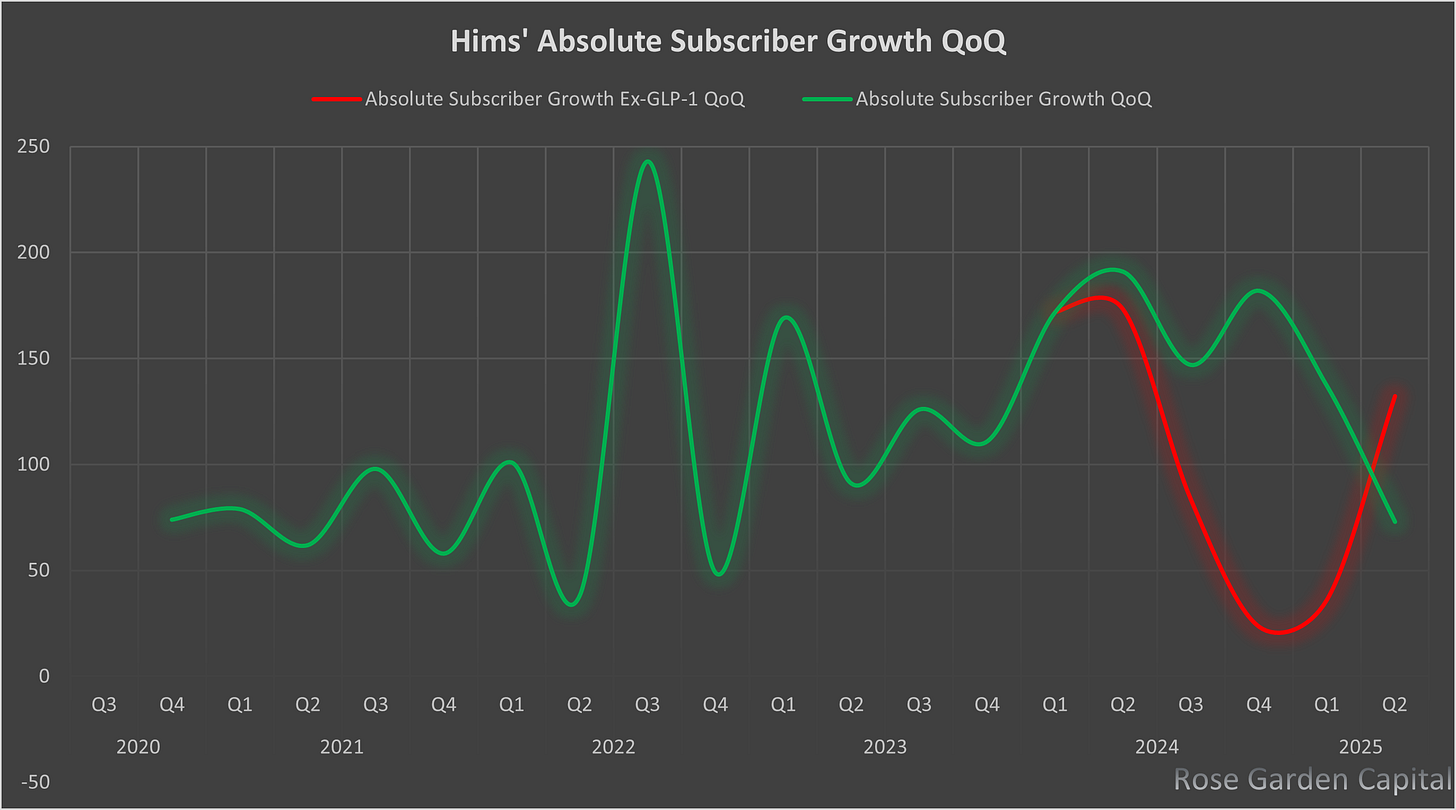

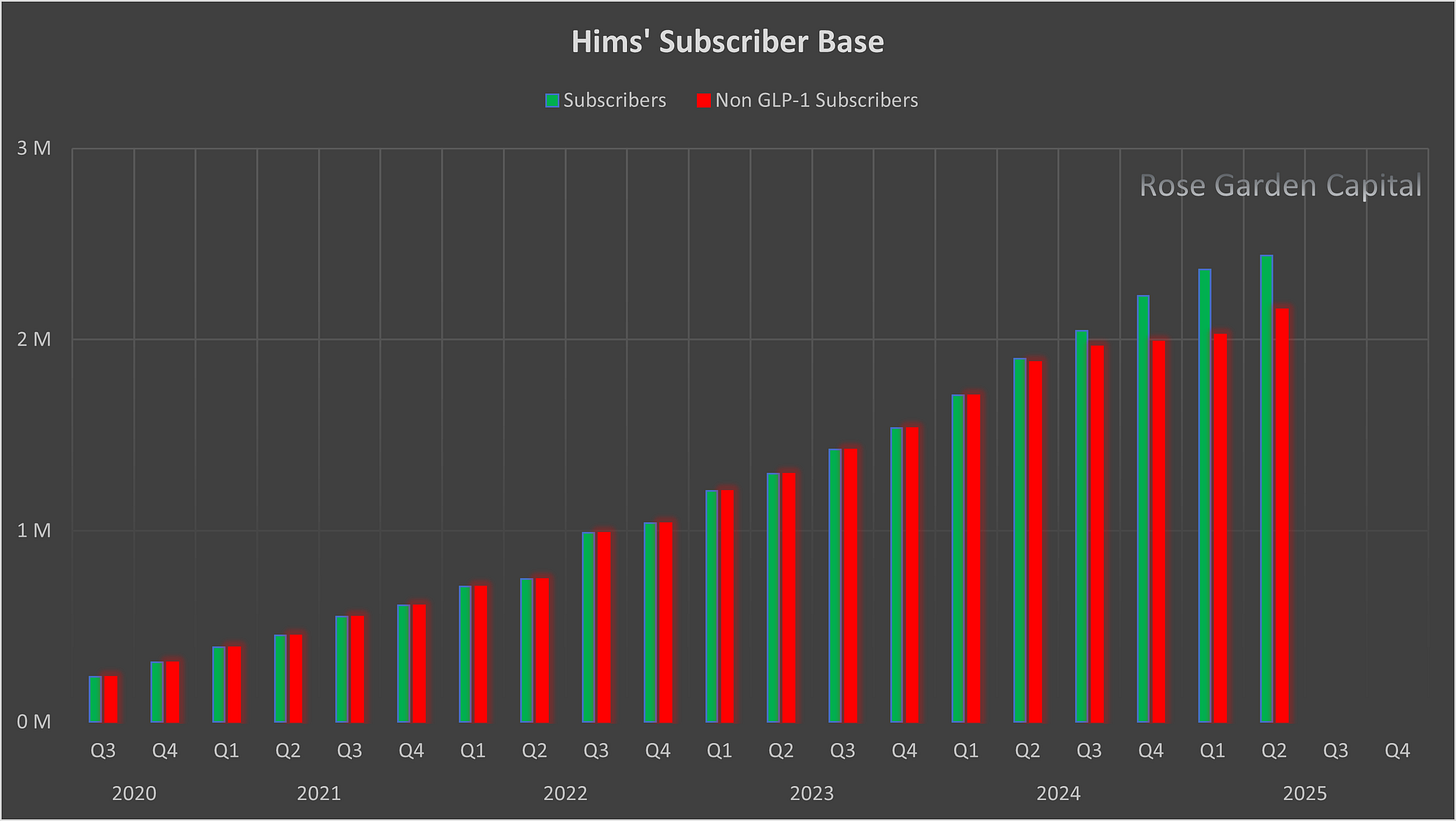

Subscriber Base – Stronger Than Headline Numbers Suggest

Quarter-over-quarter net subscriber additions totalled 73 thousand, the smallest increase since Q4 2022. Beneath the headline, however, core subscriber growth was robust: the core subscriber base expanded by 132 thousand** to 2,158 million, the strongest quarterly gain since Q2 2024.

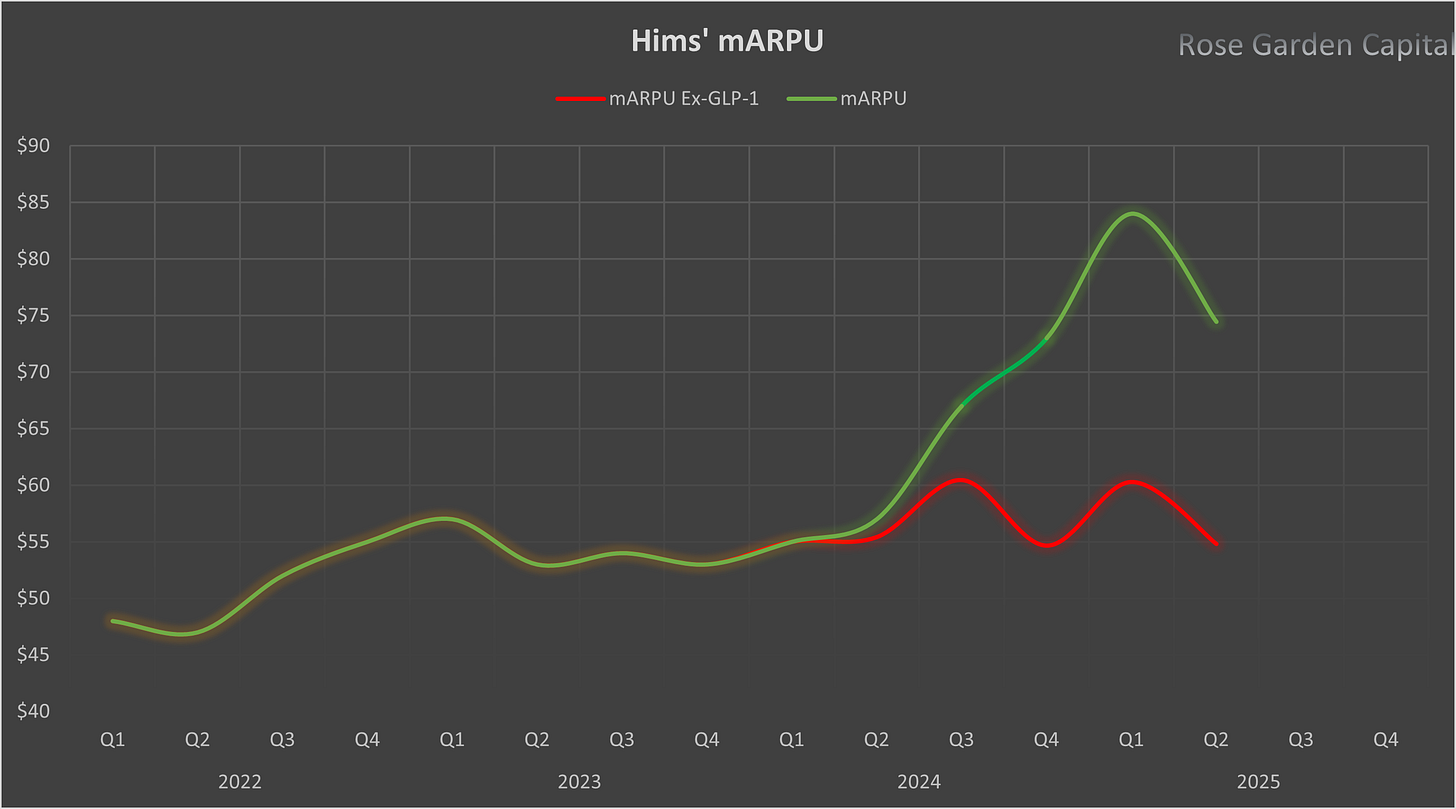

Had monthly average revenue per user (mARPU) held at Q1’s $84, Q2 revenue would have been 13 % higher at $615 million.

Average Revenue per User - Unexplainable Softness

The monthly average revenue per user (mARPU) experienced the steepest quarterly decline in company history, falling by $10 from $84 to $74. A degree of softness was expected, as the sale of commercially available GLP-1 dosages had to be discontinued following the end of the national shortage. This shift was known to impact GLP-1 revenue negatively, and by extension, lower the blended mARPU.

However, the scale of the decline significantly exceeded expectations. Even after excluding GLP-1 revenue, mARPU still dropped meaningfully, from $60 to $55. The conference call provided no clear explanation for this drop. It is unlikely that a single driver is to blame. Instead, it likely reflects a combination of product mix shifts and promotional pricing aimed at boosting retention.

It is also plausible that the strong growth in core subscribers was directly or indirectly linked to the lower mARPU, indicating that management was able to convert pricing pressure into volume gains. While that may have softened the revenue impact from lower mARPU, the sudden downturn is nonetheless worrying. If mARPU erosion were to continue, it would materially weaken customer lifetime value and undermine the company’s marketing-led growth model.

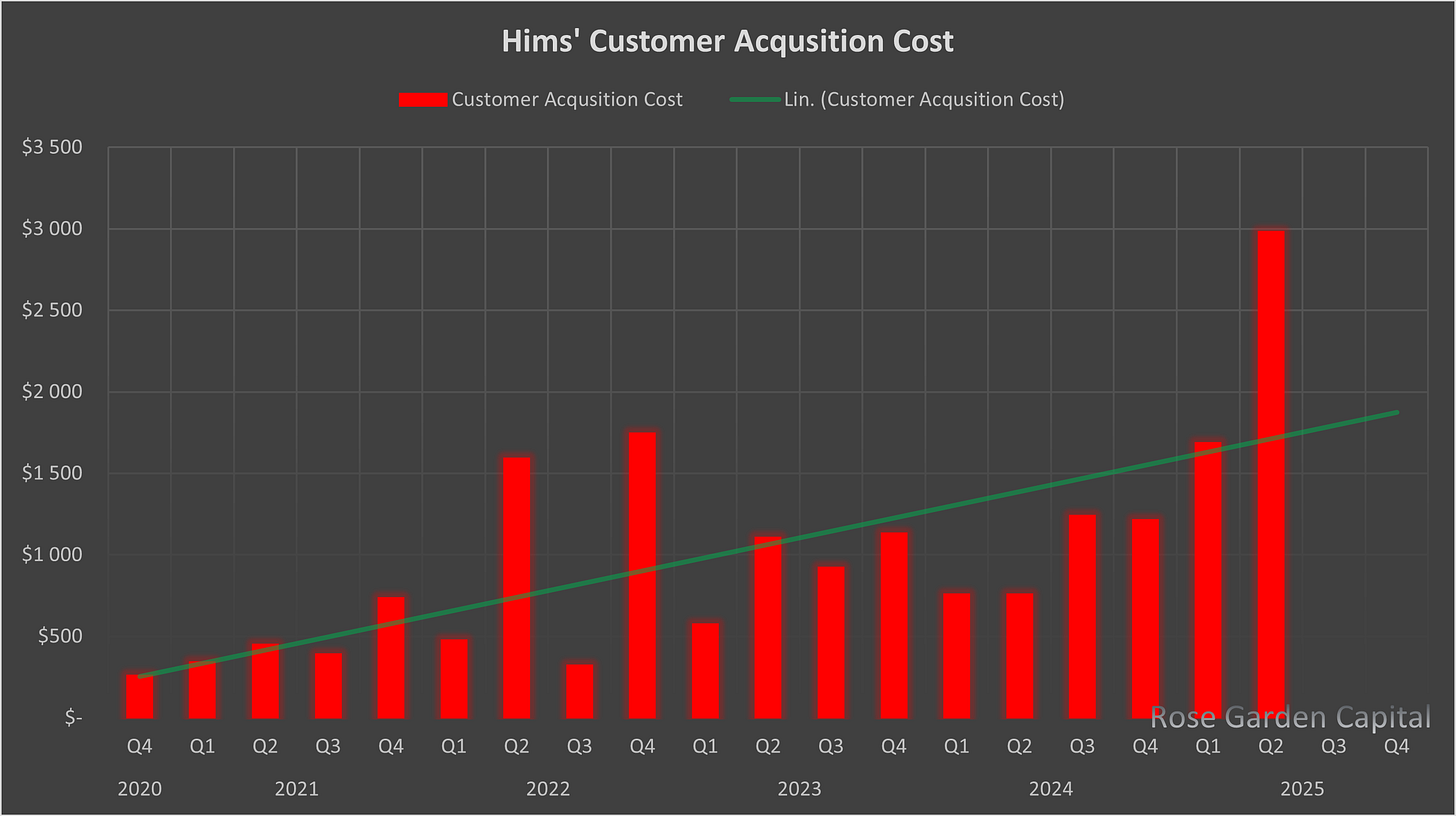

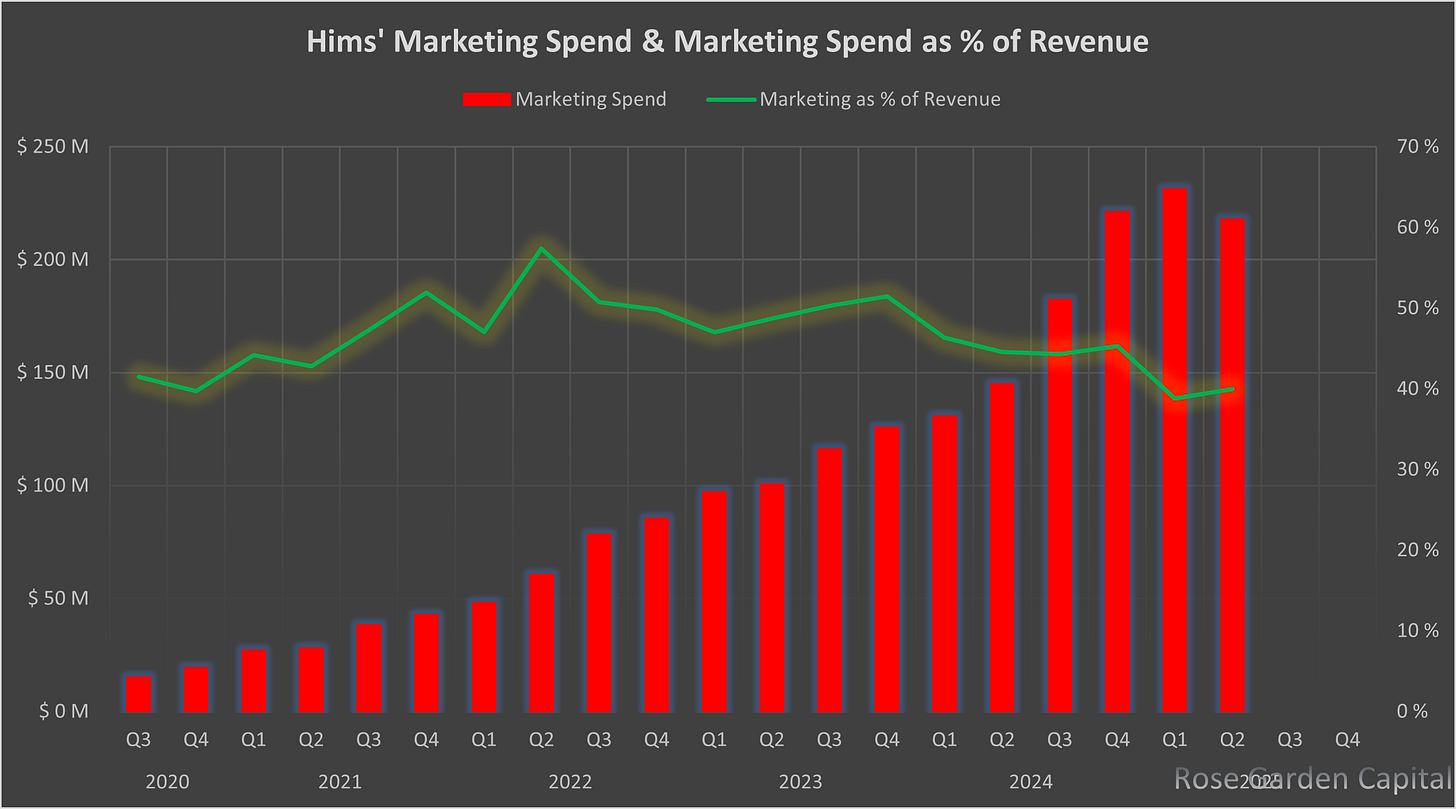

Customer Acquisition Cost - Through the Roof

Customer acquisition cost (CAC) climbed to a record high in Q2 2025. The company added just 73 000 net subscribers while spending $218 million on marketing—a marginal decline from $231 million in Q1. The sustainability of such elevated CAC is questionable, particularly if the recent softness in mARPU signals emerging price pressure in the core business.

It is worth noting that this quarter’s higher CAC partly reflects elevated subscriber churn following the end of the shortage. However, because GLP-1 customers generate roughly four times the mARPU of core subscribers, the outflow is modest in subscriber numbers but disproportionately large in revenue terms.

When eyeing marketing spend from a more forgiving perspective, expressed as a percentage of revenue, the figures appear relatively stable. Although, if Hims aims to become a compounder, marketing spend should meaningfully scale with revenue. Thus far Hims has shown no ability to achieve this. On the contrary, growth has become increasingly expensive with no improvement in sight.

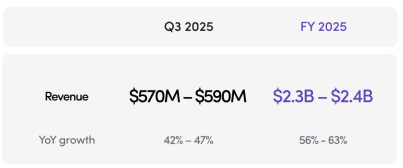

Guidance – ZAVA Is the Saving Grace

Full-year 2025 revenue guidance was reinstated between $2.3 and $2.4 billion.

ZAVA Expected to Contribute $50 million in H2

ZAVA’s contribution is critical to meeting full-year guidance. Including the acquired ZAVA business without raising the overall target effectively amounts to a reduction in organic guidance. As a result, the implied organic guidance range for FY 2025 falls to $2.25 to $2.35 billion.

Assuming the $50 million ZAVA contribution is split across H2 as $23 million in Q3 and $27 million in Q4, the implied organic guidance for Q3 is between $548 million and $568 million. That equates to just 0,5 % to 4,2 % organic growth quarter-over-quarter—down sharply from the 73 % year-over-year growth seen in Q2, now expected to slow to 33 % to 38 % in Q3.

As GLP-1s are the only segment still growing, the guidance, in our view, indicates that both core revenue and core subscriber base are effectively guided to decline organically QoQ in Q3.

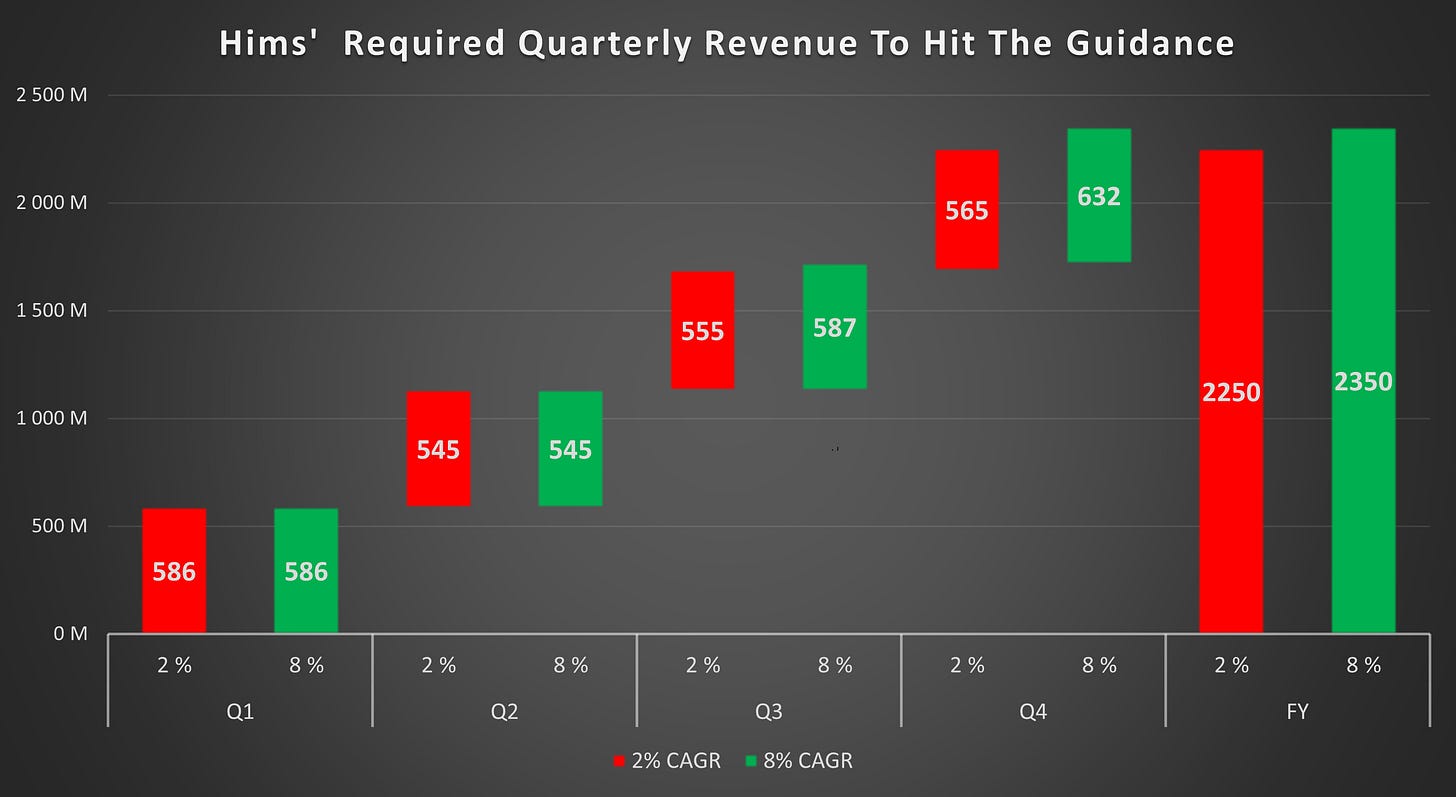

The lower end of the full-year guidance still looks attainable if the GLP-1 segment runs without disruption in H2. Figure 10 shows the quarterly CAGR needed to reach the effective organic guidance, starting from Q2, since H2 conditions are expected to mirror the post-shortage environment of that quarter.

Legal Risk - Novo Nordisk Holds All the Cards

Roughly 40 % of Hims’s revenue is tied to compounded semaglutide, whose sales may infringe Novo Nordisk’s patents. Liraglutide sales remain negligible as long as compounded semaglutide is widely accessible.

When the collaboration with Novo Nordisk was first announced Hims adopted a cautious approach to compounding. Yet in the weeks leading up to the agreement’s termination the company intensified its marketing of compounded semaglutide and has only accelerated those efforts since. The drug is now offered to virtually any customer, including first-time users who could not reasonably require a “personalized” formulation to mitigate side effects.

To hit its guidance Hims must keep driving compounded semaglutide, since it is resonable to expect the core growth to remain at a modest level. The dependence strengthens Novo Nordisk’s legal position if it chooses to take action.

Management Delivers What Management Is Incentivized to Deliver

The remuneration of the executive team is largely tied to annual revenue and adjusted EBITDA targets. As GLP-1s are practically the only segment driving growth and likely carry higher gross margins, they also make a disproportionate contribution to EBITDA. Promoting GLP-1s is therefore an obvious strategic focus for management. However, the ramifications for shareholders could be severe if the situation were to evolve in an unfavorable direction.

** Figures based on a monthly average price of $225

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance.