Faron Pharmaceuticals — Death Spiral Deepens

We take a look at Faron's year 2025 and evaluate whether the Second Tranche Bond was a rational choice when compared with alternatives available under the short runway.

Faron Pharmaceuticals is a Nordic biotechnology company listed on First North Helsinki and on the AIM market in London. The company develops immuno-oncology therapies with bexmarilimab as the lead asset and is preparing for Phase II/III. Faron is currently in the process of seeking financing to advance its clinical programs.

In this article, we take a look at Faron’s year 2025 and its positioning for 2026 and several other key aspects. The article is divided into six chapters as follows:

Chapter 1: Where Is Faron & What we know

Chapter 2: HCM Bonds & Junk Equity

Chapter 3: HCM Bond Tranches & Valuations

Chapter 4: Licensing Deals

Chapter 5: What Analysts Get Wrong

Chapter 6: Merry Christmas

CHAPTER 1: Where Is Faron & What We Know

Liquidity

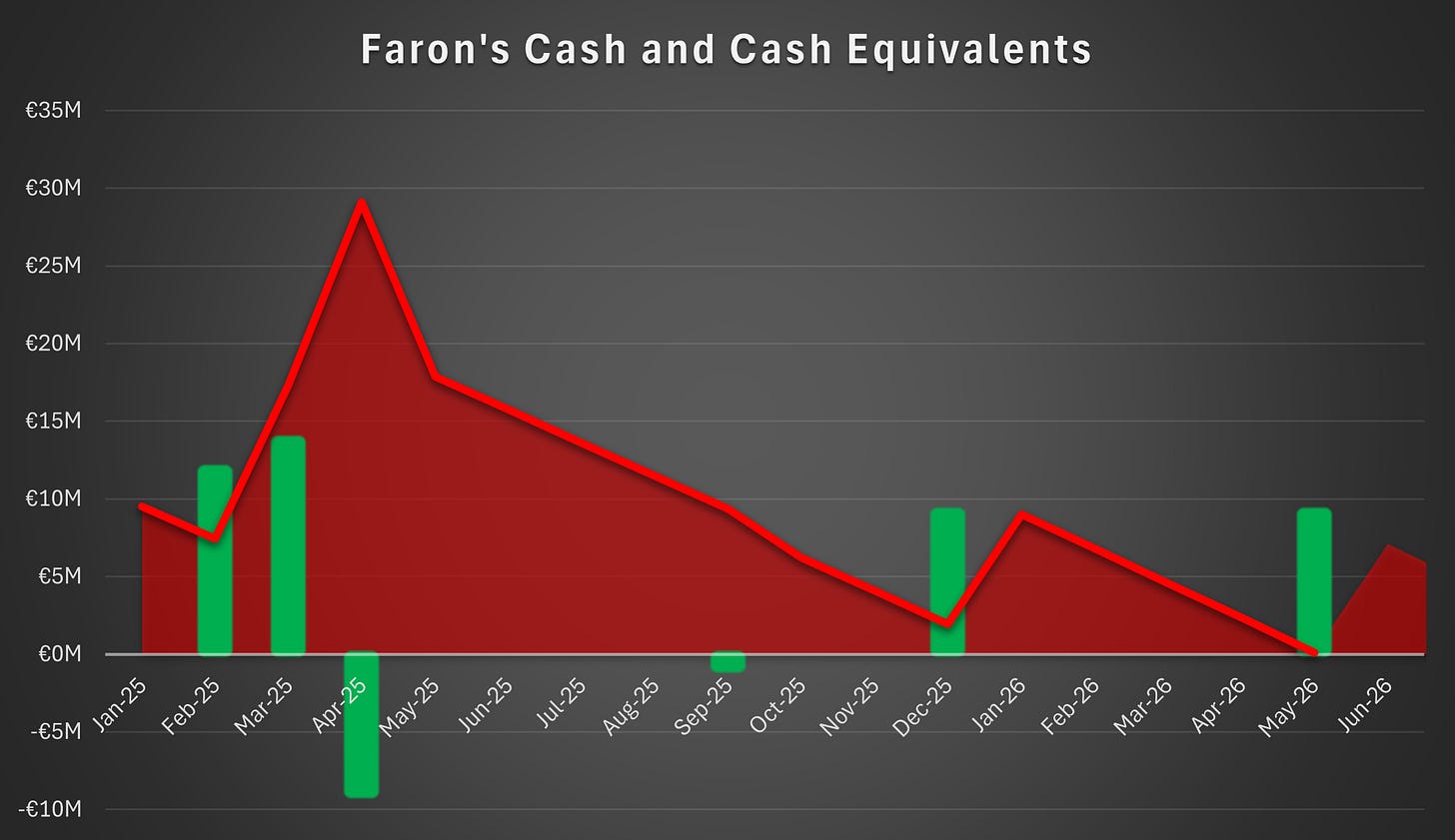

Before announcing the issuance of the second tranche HCM bond, Faron’s cash position stood at slightly over €2 million, sufficient to fund the company for approximately six weeks.

The Second Tranche HCM Bond provides the company with cash proceeds of €9.25 million, sufficient to extend the financial runway by approximately 4–5 months, until May 2026.

The Second Tranche HCM Bond was the only secured financing instrument. Following its issuance, Faron’s ability to fund operations over the next twelve months remains unclear, and there is no assurance that the company can identify solutions that address the liquidity gap in a value preserving manner. The HCM agreement includes a Third Tranche Bond which, however, contains terms that Faron must satisfy to retain the right to issue it through a unilateral decision. At present, it is unlikely that Faron will be able to satisfy the terms. Please refer to chapter three for further discussion of the topic.

PR-campaign in August

On August 2nd, Faron covered the econd scheduled First Tranche HCM Bond instalment in cash, amounting to approximately €1 million. At the time, Faron held approximately €11.5 million in cash, and thus paid HCM roughly 9% of total available liquidity without any clearly articulated rationale.

At the time, the most credible explanation for the cash amortization was that the company was closing in on a partnership agreement, and thereby on the verge of securing non-dilutive funding in the form of an upfront payment in exchange for global or regional rights to bexmarilimab in selected indications. In such a scenario, there is a pronounced information imbalance between management and the market, as management is aware of a transaction that is expected to increase the value of the company’s share while the market is not. As management’s mandate is to create shareholder value by increasing the price of the company’s shares, it is rational to settle the payment in cash if the prevailing market capitalization does not reflect the company’s fundamental value. If there is no information asymmetry, the settlement method, cash or shares, is largely indifferent and differs primarily due to the effective 10% discount applied to in-share payments.

The speculation quickly withered, as HCM advanced two payments only five days later, which Faron covered in shares. The true reason for the erratic decision remains unclear. CEO Dr. Jalkanen had purchased a small number of shares only a month prior, suggesting that no inside information was yet expected to be disclosed. Furthermore, the positive signal to the market was likely to be short lived in any case, as if it was a bluff, it was set to be called very soon, if not by HCM, then through some other avenue.

This sequence underlines how Faron’s management makes decisions that are difficult to interpret as an outsider and often lack an evident financial rationale. It makes predicting future developments based on known events difficult, as one cannot operate under the premise that the company makes only rational decisions. The IPF loan repayment is another prime example in this regard.

Early IPF repayment in April

In April 2025, in conjunction with the HCM bond agreement, Faron decided to terminate its loan agreement with IPF Partners by repaying the remaining principal early. The IPF loan, in aggregate, was highly similar in economic substance to the HCM bond. The IPF loan carried interest at three month EURIBOR plus 9%, rendering it arguably less expensive than the HCM bond on a like for like basis. Please note that the coupon of the HCM bond is not directly comparable to the interest rate of the IPF loan, as the coupon is merely a technical parameter used to calculate periodic coupon payments. For further discussion of the effective cost of the HCM bonds, please refer to our earlier article, where we examined the matter in greater detail here.

Unlike the HCM bond, the IPF loan included warrants as a kicker. However, when assessing the early repayment of the IPF loan, these kickers are not relevant, as they were issued in conjunction with the loan and therefore constituted sunk costs at the time of the early repayment.

Furthermore, the IPF loan was secured, unlike the HCM bond. Later in this article, we will argue why the collateral was not as material a downside for Faron as management has suggested, and how such collateral packages can be mutually beneficial in the context of pre revenue biotechnology companies.

One last key difference between the instruments is that Faron may choose whether to settle the HCM bond instalments in shares or in cash, which was not the case under the IPF loan.

Faron used the majority of the proceeds from the First Tranche Bond to repay IPF the loan amount in full. The principal amount, including accrued interest, was just under €8 million at the time, on top of which Faron paid a substantial €1.1 million early exit fee. The exit fee was material, raising the question of why Faron was so willing to pay an exit fee amounting to over 13 per cent of the remaining loan balance in order to exit a transaction it had previously described as something that

strengthens our financial position and adds flexibility to our funding strategy.

On the other hand, the HCM bond agreement adds little flexibility. In practice, the principal flexibility it may add relates to the absence of covenants requiring a specified cash buffer. Conversely, it materially reduces flexibility with respect to financing alternatives, as Faron cannot issue further HCM Bond tranches nor equity without resetting the conversion price of the existing tranches. For more on the topic, please see chapter three.

The True Reason Behind The Early Exit

As previously calculated, the effective interest rate of the HCM bonds (if paid in cash), is

which gives us an interest rate of 2.16 % for every two-month period, which equates to:

This is before accounting for the substantial exit fee payable to IPF and the effect of the discounted in-share payments. Thus, it is clear that the rationale for the early repayment cannot have been monetary, at least insofar as it concerns the standalone cost of financing in isolation. Thereby, the actual reason must be some other, possibly:

Faron wanted to get rid of the minimum cash and gross gearing covenants

Faron wanted to release the patents from the collateral

Faron and the new management wanted to get rid of the IPF loan

Faron needed to secure further debt financing which would not have been possible while still having the IPF loan

The first two possibilities are somewhat counterintuitive: running cash reserves down to the brink is not attractive for either the lender or the borrower. Especially in the context of a biotechnology company, maintaining adequate liquidity buffers is of major importance, as extending the runway too aggressively can lead to financing distress, which may necessitate expensive bridge financing and equity issuance under adverse market conditions. Similarly, collateral protects both the lender and the borrower, thereby lowering the implied cost of debt through improved credit protection. Furthermore, aving the patents as collateral is not a limiting factor when it comes to partnering as many companies hold secured debt before partnering. This is despite CEO Dr. Jalkanen stating the opposite.

The third case stems from Faron’s fatal mistake in spring 2024, when management failed to raise capital in time, leading to a breach of the IPF loan covenants, which resulted in IPF taking action in order to secure its investment and reduce the risk of default on the loan. The covenant requirements were clear and there was no excuse for the strategic mistake of running too low on funds. The incident resulted in Faron having to issue shares at an unfavorable valuation to avoid bankruptcy, which proved detrimental to existing shareholders. Given the time pressure, Faron had no time to prepare for a traditional rights issue and, thus, was forced to commence a share issue without preferential rights for existing shareholders, something that no company should ever do because it, by definition, destroys shareholder value when the strike is below the market price before the announcement. IPF’s actions were justified, but it is no wonder that Faron wanted to terminate the agreement at the first possible opportunity.

In the fourth case, we shall consider a scenario, where Faron had raised an amount corresponding to the net proceeds of the First and Second Tranche HCM Bonds excluding the IPF repayment (13+9-8=€14 million) through other avenues. Issuing HCM bonds on top of the IPF loan would not have been permitted by IPF, so the funding would have likely been equity based. Can Faron any longer attract equity investments at a reasonable discount to the prevailing share price? The issuance of the HCM bond suggests that no, which marks a key disadvantage for Faron going forward.

For more on the topic, please refer to chapter three, where we compare Faron’s financing options in more detail.

Faron Is Issuing New Shares To Cover HCM Bond Instalments

On 27 May, Faron issued 5,000,000 treasury shares with a single purpose:

to further prepare for any future conversions of the First Tranche Bond.

The first HCM bond instalment fell due before the shares could be registered. The second instalment was, surprisingly, paid in cash, while the two subsequent accelerated instalments were settled in shares using the treasury share balance. Oddly, the third and fourth scheduled instalments, as well as the third advanced instalment, were covered by issuing new shares rather than using the treasury shares that were initially created for this sole purpose.

There is little reason to deviate from the declared purpose only a few months later, unless Faron has a specific rationale for preserving the treasury shares. At present, we are unable to offer a substantiated explanation for why Faron has chosen to act as it has. We consider that Faron should publicly disclose whether the intended use case for the issued shares has changed, as this would constitute material information to which shareholders are entitled.

Indicated Timeline No Longer Credible

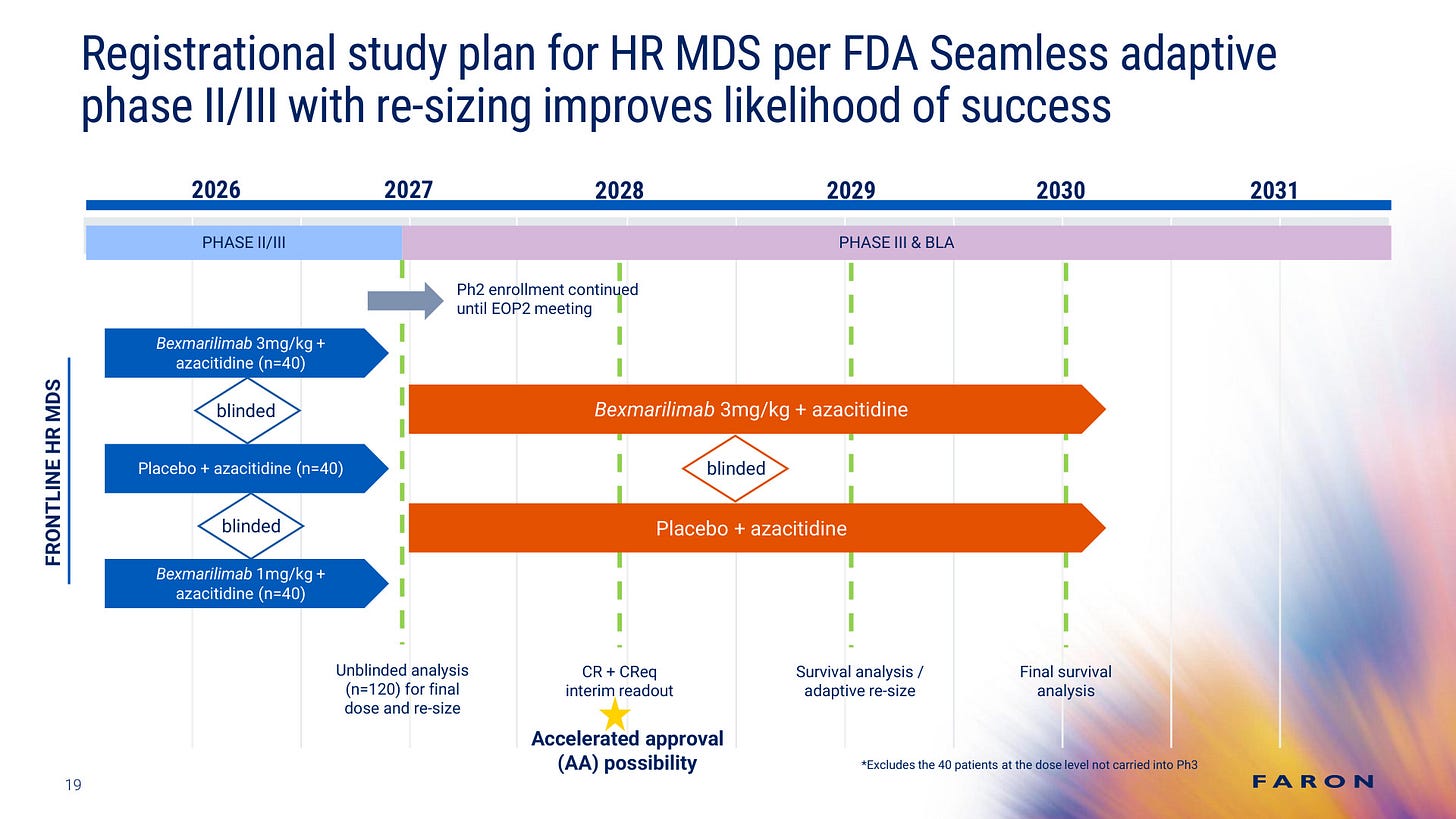

Faron is aiming to recruit the first patients into the BEXNOVA study in Q2 2026. Given the delays in securing funding for the study, we consider the stated timeline to be no longer credible.

CHAPTER 2: HCM Bonds & Junk Equity

What Are The HCM Bonds

The HCM bond is a debt structure that provides Faron with the option to settle any instalment in shares at a discount of at least 10% to the prevailing share price. Additionally, HCM has the right to convert the outstanding bonds into shares at a fixed conversion price, subject to reset provisions, which we discuss in chapter three. For more on the bond arrangement, please refer to our earlier article, which covered the topic in more detail here.

In academic literature, convertibles with floating conversion prices are often referred to as ‘junk equity’, ‘toxic convertibles’, or ‘death-spiral convertibles’, as empirical evidence suggests that entering into such unfavorable financing structures tends to depress the share prices of the respective issuers. We presented empirical observations of the share price performance of European life science companies that have entered into death spiral convertibles issued by HCM. If you have not read the article, please feel free to refer to it here before progressing, as it offers valuable background information. As a result, we found that none of the peer companies has been able to generate positive returns for shareholders after relying on HCM financing, with an average annualized return of -70.29% since the transaction. Our findings are consistent with academic research, which has found that a stock price declines by an average of 34% after one year following the issuance of a death-spiral convertible and that 85% of cases generate negative one-year returns. However, it is worth noting that not every death spiral bond holds identical terms. Herein, we refer to any bonds that include a floating price conversion mechanism as death-spiral convertibles.

In theory, convertible bonds that are repaid in the future are superior to equity financing in situations where management believes that the company’s current share price is depressed. This may be because management has information it is unable to disclose publicly, or is unable to convince the market that the share is underpriced. In that way, the company can secure funds now and expect that the mismatch between perceived value and price narrows over time. However, in practice, and particularly in the context of death-spiral convertibles, the issuer often has limited alternatives beyond such structures.

The Optimal Strategy For The Bondholder

The optimal strategy is the approach that maximizes the value of the bond to the bondholder. The strategy depends, of course, on the precise structure of the convertible, but we can examine a standardized case in which certain key conditions hold. That is, that there is:

A reference price or a set of reference prices, of which typically the lowest is selected. In Faron’s case, the reference price is the lowest of

the fixed conversion price

the Volume Weighted Average Price (VWAP) on the relevant payment date

the lowest of the VWAPs on each of the five consecutive dealing days ending and including the dealing day immediately preceding the relevant payment date.

A conversion price that is set at a discount to the reference price. In Faron’s case, the discount is 10 per cent to the reference price.

Given these constraints, the bondholder can sell the shares short once the longest maximum reference price window has begun. That is, when the longest period in the reference price set has started. In Faron’s case, that is immediately if the bond is in-the-money with respect to the fixed conversion price, and five days otherwise.

By selling the shares short, the bondholder can not only lock in the profit, but also increase profits if the share price falls as a result of the short selling or otherwise. This is because the minimum number of shares the holder is set to receive is fixed, and therefore is certainly sufficient to cover the short position. This is the origin of the nicknames toxic, as bondholders’ and shareholders’ incentives are clearly opposed, and death-spiral, as the price decline translates into more shares for the bondholder, which enables additional shorting and deepens the spiral. Mathematically, this equates to an extra profit of

where:

In Faron’s case, there exists a possibility that Faron opts to settle the instalment in cash. In such a case, HCM appears to be exposed, as it bears risk due to an open short position that it would then need to close by buying shares in the market. However, this seemingly important flaw is mitigated by HCM’s right to bring forward payments in between the scheduled payment dates. Furthermore, at present, the company is not in a financial position where it could elect to settle any instalments in cash.

HCM’s Realized Strategy

It is difficult to borrow shares on First North. Perhaps as a result, HCM has not utilized the strategy outlined above. The realized strategy appears to have been to sell the shares only after receiving them, often on the very same day. Should HCM adopt the optimal strategy, it could induce further downward pressure on the share price.

HCM Is A Predator

As outlined above, death spiral convertibles are a toxic structure designed to transfer value from shareholders in favor of the bondholders. In such a relationship, it is clear that bondholders occupy a position of structural bargaining power with respect to both the debtor and the shareholders.

We saw an embodiment of the toxic structure when Faron requested the Second Tranche to be subscribed by HCM. It took 17 days for HCM to act upon the request. On the first trading day after the request, Faron’s share price fell by approximately 7% to €2.085, reflecting the reduced equity valuation. During the 17 day period, one scheduled instalment fell due, which HCM sold into the market at the first opportunity. As a result, HCM was able to lower the reference price used to calculate the conversion price for both the First and Second Tranche convertibles to €2.02, amounting to an approximately €70,000 gain for HCM and an equivalent cost to shareholders.

CHAPTER 3: HCM Bond Tranches & Valuations

Was Issuance of The Second Tranche HCM Bond a Sensible Choice?

On 24.11.2025, Faron requested HCM to subscribe to the Second Tranche Bond, as per the agreement. The reason for the decision was that the company was about to run out of cash and needed to secure additional funding. Given that the financial runway was only one to two months, effectively the only other option, besides a non-dilutive partnership upfront payment, was either a directed issue or the Second Tranche Bond.

To assess which of the options was more favorable, one must understand the factors affecting relative attractiveness, as well as the definition of favorable. Herein, our perspective is that of ordinary shareholders, that is, shareholders who are not invited to participate in directed share issues. Consequently, favorability is defined as which option costs ordinary shareholders the least, that is, the option that results in the greatest equity attributable per ordinary share.

As per these definitions, the impact of issuing the Second Tranche convertible consists of two factors: the valuation premium embedded in the Second Tranche convertible relative to the cash proceeds, and the impact on the reset mechanism with respect to the First Tranche Bond.

Price Reset Mechanism

The bond agreement includes a price reset mechanism that resets the conversion prices of the outstanding convertibles in the event that further HCM bonds or equity are issued. The company has not publicly disclosed the precise terms governing the price reset mechanism, but we believe them to be as follows. When issuing further tranches of the HCM bonds, the existing tranches reset to the conversion price of the newest tranche if the new conversion price is lower than that of the previous tranche. Furthermore, any equity offerings would reset the conversion price to the offer price of the equity issuance.

We believe that the company should publicly disclose the precise terms of the price reset mechanism, as the absence of such information induces unnecessary uncertainty and speculation. Furthermore, it makes evaluation of the company’s future financing options more difficult, as we cannot be certain of all the implications of such options. Our understanding of the price reset mechanism is based on comparable agreements involving HCM and the Monte Carlo simulation presented in Faron’s internal reporting.

Valuing The Impact Of The Issuance Of The Second Tranche Bond

The impact of issuing the Second Tranche bond equates to the increase in the value of the First Tranche resulting from the conversion price reset, and the value of the Second Tranche Bond, less the cash proceeds raised. Mathematically, it amounts to:

where:

To arrive at consistent valuations, we have obtained a Monte Carlo model consistent with the one used in Faron’s internal reporting. Please note, however, that we do not necessarily consider all the assumptions underpinning the parameters to be fully credible, but to achieve consistency with the values reported in Faron’s half year reports, we have decided to adhere to them. This also enables you to compare the valuations more directly with those reported by Faron. Should Faron choose to alter the parameters in forthcoming reports, we will publish updated models consistent with such changes. Please consider subscribing to be among the first to gain access. Subscribing is free and we guarantee not to present any advertisements nor to employ any paywalls.

Introducing The Model

The Monte Carlo model is used to address the challenges arising from the prevalence of unobservable inputs, such as equity issuances, that affect the valuation of the convertibles. We run the simulation 1,000,000 times to arrive at an expected outcome, which represents the current fair value of the instrument. The process is as follows, consistent with the methodology used in Faron’s internal reporting:

Simulate monthly share price development using Geometric Brownian Motion

Simulate Qualified Equity Offering (QEO) events using a Poisson process that triggers conversion price resets

Simulate Change of Control (CoC) events using a geometric process

Evaluate the criteria for the Second Tranche Bond and, if met, reset the conversion price of the First Tranche

Calculate discounted coupons and instalments

Calculate total cash flow and terminal payment

Please note that step four is omitted when calculating the value of the First Tranche bond after issuance of the Second Tranche bond, or when calculating the value of the Second Tranche Bond. The terms for the Third Tranche Bond are as follows:

The arithmetic mean of the daily traded value of the shares on each trading day comprised in the three-month period preceding the issuance of the Third Tranche Bond is greater than €0.5 million and

the market capitalization is greater than 120% of its market capitalization on the date of issuance of the Second Tranche Bond.

The Third Tranche Bond can be issued only six months after the Second Tranche Bond, at earliest 11.05.2026

The first condition is achievable, but the second is more complicated: should Faron enter into a partnership agreement, it is unlikely to need to issue the Third Tranche Bond. Conversely, if not, the market capitalization is unlikely to exceed the required threshold. Furthermore, Faron’s cash runway is only barely long enough to support operations until 11.05.2025. The required market capitalization amounts to €231 million, as the share price on the issuance date was €2.02 and the number of outstanding shares was 114.42 million. In May 2026, the number of outstanding shares will amount to approximately 116.2 million, assuming the share price remains at €2, no shares are issued beyond those related to the HCM bond, and no payments are accelerated.

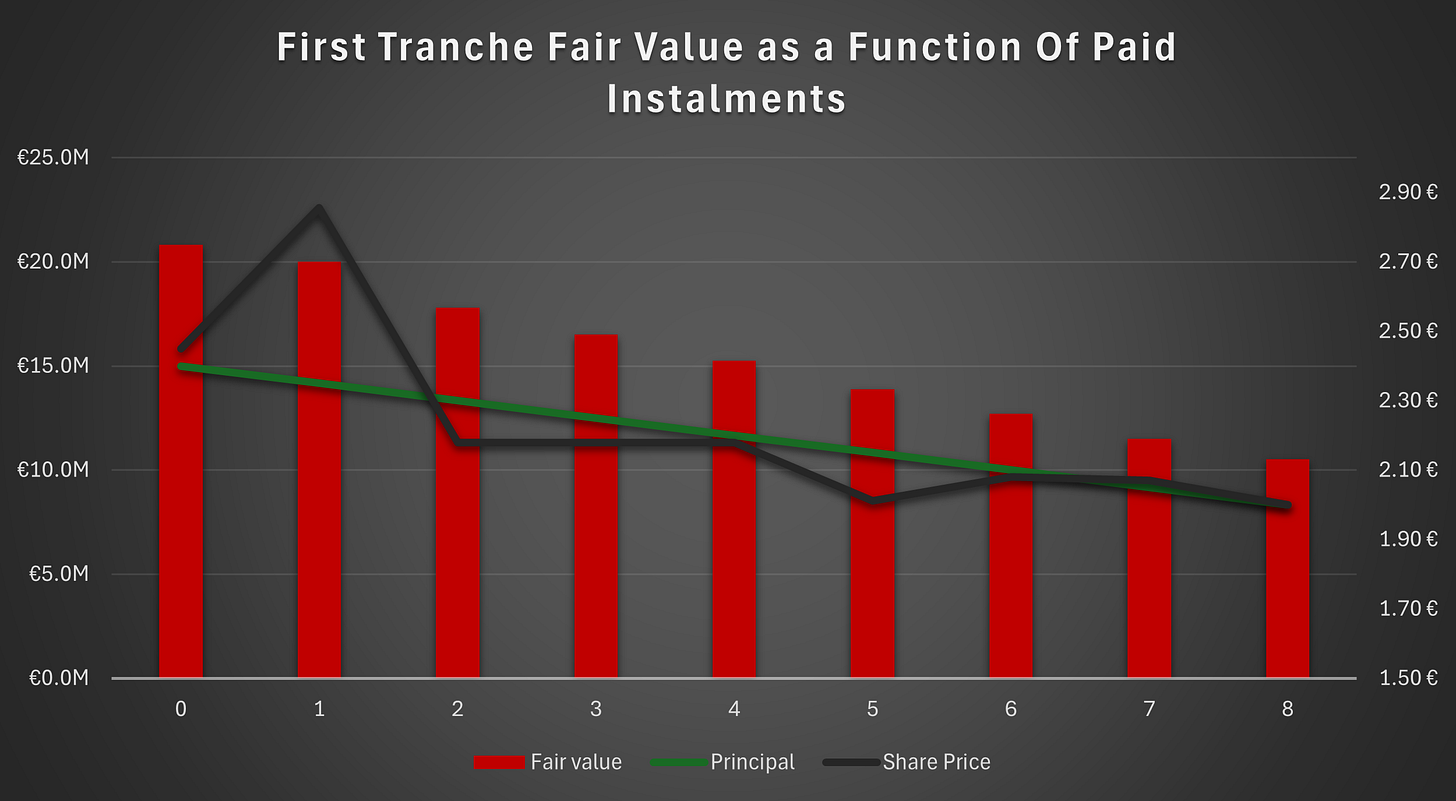

Value Of The First Tranche Bond

Here are the key parameters of the First Tranche Bond as of the release of this article (15.12.2025):

Principal: €15 million principal, issued at 92.5 % of par

Maturity: 2 October 2027, originally 2 April 2028

Coupon: 7.5 % p.a.

Amortization: 18 equal installments, beginning on June 2, 2025

Conversion price: €2.42, originally €2.94 (20% premium)

Settlement: Cash or shares at 90% of VWAP of the reference price

Remaining principal: €9.2 million, 11 instalments

As a result, we can conclude that after the seventh payment and the reset, the First Tranche Bond is valued at €11.7 million, approximately 125% of its principal, as opposed to €11.5 million, should the reset not have occurred. Similarly, the Second Tranche Bond is valued at €13.9 million. Thus, the total fair value of Faron’s debt at present is approximately €25.9 million, comparable to a remaining principal of €19.2 million.

Correspondingly, we can assert that the impact of issuing the Second Tranche Bond amounts to:

A €4.85 million loss in equity value amounts to approximately €0.04 per share, accounting for some of the share price decline on the day after the announcement. The remainder is attributable to the delays for which the issuance of the Second Tranche Bond served as a signal.

Comparing The Second Tranche Bond To a Directed Issue

Now, let’s consider a directed issue, where the company would have raised the same amount of funds (€9.25 million) at a 10% discount to the share price preceding the announcement of €2.24, corresponding to an issue price of €2.02. In this scenario, 4.58 million shares would have been issued.

We consider that the First Tranche Bond would have been reset to the issue price of €2.02, instead of €2.42, resulting in an increase in value of €0.7 million, or €0.5 million more.

Thus, the impact of a share issue would have amounted to:

where:

and:

The equity impact amounts to €1.7 million, well below the comparable €4.85 million. This is before accounting for the fact that the values of the convertibles will increase materially should management succeed in its objective of attracting a partner on favorable terms. This suggests that investors are unwilling to invest in Faron even at a discount, or that alternatives were not considered, as issuing shares at even greater discounts would have been more favorable for existing shareholders than issuing additional death-spiral convertibles.

The company stated that:

The Board has conducted an overall assessment of the issuance of the Second Tranche Bonds, considering its key terms and commercial merits, the reputable standing of HCM as well as other explored financing alternatives potentially available to the Company.

The comment suggests that either the board’s ‘overall assessment’ has been conducted very poorly, or that directed issues are no longer a viable alternative for the company. Neither possibility reflects favorably on the situation.

In fact, the issue price in a comparable directed issue could have been as low as €1.65 and still have been more favorable for existing shareholders than the issuance of the Second Tranche Bond. This further underlines how unfavorable and expensive death-spiral convertible financing can be, and how it is in shareholders’ best interests to avoid such structures at almost any cost. We find the board’s ‘overall assessment’ insufficient to justify bypassing shareholders’ preferential rights.

KPIs to Consider

As outlined in chapter 2, death-spiral convertibles are a toxic structure that can prove detrimental to the share price. However, the impact scales with the size of the payments relative to the company’s market capitalization. That is, the larger the payments are in relation to market capitalization, the greater the risk that the well documented dynamics of death-spiral convertibles become pronounced. It remains to be seen whether Faron’s management can generate sufficiently positive catalysts to keep the share price supported despite increasing selling pressure stemming from the toxic convertibles.

CEO Comments

Faron CEO Dr. Jalkanen commented on the announcement regarding the request for HCM to subscribe to the Second Tranche HCM Bond:

This is the exact situation for which this bond structure was designed for, and we are very pleased with HCM’s continued support.

Is it really? From HCM’s perspective, certainly, as the bond offers attractive returns to HCM with limited risk. However, given that a company’s chief executive should consider the shareholders’ perspective, the comment appears bizarre. Is a convertible with a fixed conversion price truly designed for a moment immediately before Faron is set to achieve a transformative global partnership agreement with a large pharmaceutical company? The comment makes the CEO appear either uncompetitive or poorly informed, assuming the earlier remarks about seeking a partnership at this stage remain valid.

The latter part, where Dr. Jalkanen says that the company is very pleased with HCM’s continued support, is similarly odd. It took HCM 17 days to act upon Faron’s request to subscribe to the Second Tranche Bond. Is such a delay a sign of continued support, particularly when the company’s cash reserves depend on the funds from HCM and such a delay could have created liquidity stress, for example if the company had needed to undertake working capital investments? This raises questions as to why Faron continues to leave financing to the last possible moment, rather than maintaining a prudent cash buffer to safeguard operational continuity.

Third Tranche Option

HCM has the unteral right to issue the Third Tranche Bond during a twelve month period, starting six months after the issuance of the Second Tranche Bond. The right is effectively a call option, which comes to play, if there are any positive news that have a substantial positive effect on the share price. That way HCM can issue the bond with a premium of 20% to the price before the upswing. The option can still be relevant, for example, in cases where Faron has to raise capital through other avenues in H1 2026, and still achieves a licensing deal in H2 2026 or H1 2027.

CHAPTER 4: Licensing Deals

What Is A Licensing Deal

In an out-licensing deal, a biotechnology company, such as Faron, typically grants a partner the rights to develop and commercialize the drug candidate in selected indications. In efficient markets, such a transaction creates no value in and of itself, as value is ultimately attributable to the molecule and its commercial prospects.

Thus, to maximize value, the drug must be commercialized in an effective manner once approved. That is, value is created when a partner can provide capabilities that cannot be sourced elsewhere.

At earlier development stages, the principal contribution from a partner’s side is capital. Inherently, there is limited incremental value that a partner can contribute before commercialization is imminent, beyond funding. Most studies are nonetheless conducted by external Contract Research Organizations (CROs), as relatively few large pharmaceutical companies maintain the internal operational capacity to run trials at scale given that their core business is not the execution of studies, but rather in development and commercialization.

Why Do Share Prices React To Licensing Deals?

Is it not a contradiction to the above that share prices react to licensing deals if they do not create value? No, since a biotechnology company’s share price is not merely a function of the pipeline, but of a broader set of variables, only one of which is the pipeline and its candidates’ future cash flows.

The value of a project is relatively straightforward to approximate, even though the cash flows are typically distant and subject to risk and uncertainty. Herein, risk refers to the Likelihood of Approval (LoA) and its components. Uncertainty, however, refers to the irreducible forecasting uncertainty that arises when projecting variables years ahead. For example, approximating the patient population of a certain disease ten years from now involves substantial uncertainty, but no risk. Thus, a licensing deal can change market expectations regarding the future cash flows attributable to one currently outstanding share.

Global Licensing Deal Is Unlikely

Faron has repeatedly stated that it is in the process of

conducting the needed business activities ahead of the registrational study in HR MDS.

Such business transactions could include raising equity or debt financing, or a combination of equity and debt. On the other hand, it can refer to selling a portion of the future cash flows of the company’s wholly owned assets for payments now, or at a specified time in the future, commonly referred to as out-licensing.

We believe that Faron is unlikely to sign a global licensing deal at this stage for the following reasons:

Faron is preparing to sponsor the upcoming phase II/III trial.

Faron is in a very poor negotiating position due to the HCM financing.

Faron’s organization and cost structure is very fat for early stage development.

Faron is a family business.

CFO is retiring.

In September, Faron announced three full time positions that indicate that Faron is preparing to act as the sponsor of the upcoming BEXNOVA study. There are few examples where a biotechnology company would have signed a global licensing deal before the initiation of a registrational study, but still retained the sponsor role. For more on the topic, please refer to our earlier issue here.

After the subscription of the Second Tranche Bond, Faron has no further secured forms of financing. As a result, the company is in a very poor position to raise additional capital, as the Third Tranche HCM Bond includes conditions that are unlikely to be met. Its issuance would require additional assurances set by HCM, which could include equity issuance. Both equity issuance and further bond issuance would reset the conversion prices of the existing debt instruments, thereby increasing the cost of such transactions. Furthermore, the company has a dual listing, which hinders its ability to conduct traditional rights issues. Effectively, this can lead to situations where the company is forced to transfer value away from existing shareholders should it opt to raise equity through directed or public share issues. Consequently, any potential partners have the option to wait until Faron produces placebo controlled data later on.

Faron’s headcount exceeds 30, which is a large number for a Nordic biotechnology company that has struggled financially in the past. Additionally, Faron has continued to hire experienced professionals who command high salaries. Should Faron out-license its lead project now, it is clear that the cost structure would need to be adjusted. However, if Faron aims for a global licensing deal after the first controlled readout in 2027, the current organizational structure appears suitable for performing the responsibilities of a sponsor of a pivotal phase II/III study. It is rare for a company to pursue business transactions that would effectively render its existing workforce redundant. This is especially apparent in single-project family businesses.

This brings us to the fourth point: Faron is a family business, which introduces an additional dimension to the analysis. If Faron can, by any means, carry the project to a material value inflection point, such as the first controlled readout, it will.

CFO Out

On 1.12.2025, Faron announced that its CFO, Mr. Wichmann, is retiring and that the company has hired Mr. Dekkers to assume the CFO role. The CFO position is central in partnering discussions, and a CFO’s departure at such a transitional moment raises questions. If Faron is indeed amid intensive partnering discussions, Mr. Wichmann’s decision to retire in the middle of them appears highly extraordinary. It leaves the company in a difficult position, as it must onboard a new executive in the midst of discussions, which can complicate and prolong negotiations, if not worse. Thus, we believe that no CFO would retire at this stage when there is an option to work a few months longer and potentially take credit for achieving a partnership agreement.

We view that it may be plausible that Mr. Wichmann’s performance was not up to standard, which may have led to operational friction and ultimately to the appointment of Mr. Dekkers. Furthermore, it could indicate that some discussions have reached a dead end, which may have enabled Faron to change the CFO without causing additional discontinuity. Furthermore, Mr. Wichmann was responsible for the HCM arrangement, which has indeed been a major flub that cannot have been overlooked by shareholders, management, or the board. Additionally, Faron’s disclosures have occasionally been subpar. However, nothing in the manner in which the retirement was announced suggests this. Either way, the chosen approach appears designed to minimize market disruption.

What Happens To Mr. Wichmann’s Options?

Mr. Wichmann holds a large number of options that may become valuable should Faron’s share price rise substantially. It is up to the board to decide, but we expect that the options remain in force.

Would Faron Consider Licensing At This Stage Had It Capital?

The reason why partnership discussions feature in the company’s communication is that Faron has little cash. Should Faron be better funded, advancing to the first part of the registrational study on a self-funded basis would be a clear strategic choice. Reaching that milestone could mark a significant increase in project value, but it could also bring the Jalkanen family to the forefront of cancer research, which would not be the case should the company decide to out-license before the major value inflection point.

Controlled data is a de-facto requirement for a favorable global licensing deal. Many Nordic companies, such as Medivir and Alligator Biosciences, have learned this the hard way. The BEXNOVA study is designed in such a way that it enables Faron to out-license the project seamlessly after the first unblinded analysis, following the dose-optimization phase.

Furthermore, the treatment of potential additional indications has likely complicated negotiations, as their monetary value is apt to be viewed quite differently by the two sides, not to mention the sentimental value that a potential widespread breakthrough may hold for a family-run business.

Regional Deal More Likely

Faron has other options besides a global licensing deal. It could opt to sign a regional licensing deal with an Asian company to secure funding, while still retaining the majority of the commercial rights and the responsibility for the forthcoming phase II/III trial. Such a transaction could offer a middle ground between the two alternatives.

If sufficiently front-loaded, such a deal could generate enough cash for Faron to fund operations until late 2027, enabling Faron to progress through the potential value inflection point, namely the readout following the phase II dose optimization phase.

Both Regional Deal & No Deal Indicate That Faron Moves Forward Individually

Should Faron choose either to sign a regional deal or to retain all commercial rights for now, Faron would act as the sponsor of the upcoming BEXNOVA trial, at least initially. This is consistent with the evidence suggesting that Faron is preparing to sponsor the upcoming trial.

CHAPTER 5: What Analysts Get Wrong

Investing In Faron Is Sequantial

Investing in Faron, or in many other biotechnology companies, is sequential. That is, events occur in sequence, and the set of feasible future events depends on prior events, whereas the outcomes of those events do not themselves depend on history. For example, a data readout in a specific program can be an event in the event space for a particular company. However, it can never be reached if an earlier event resulted in the sale of the program. That is why, by owning the company, one can effectively only take exposure to the outcome of the next event in the sequence, and the weight of any more distant events is limited, as their achievement is not necessarily probable.

This does not mean that a case based approach is redundant, quite the opposite. However, the cases must be defined in such a way that they all relate to the same event, otherwise their applicability for investors is limited. We recognize that certain constraints may exist that influence how cases can be defined, but this does not alter the underlying principle.

Debt Must Be Measured At Fair Value

When issuing convertibles where the fair value of the instruments materially differs from principal, it is of utmost importance to reflect the instruments at fair value. Otherwise, part of the instruments’ intrinsic value is overlooked.

In case-based valuation approaches, one can argue what the equity value in any given case should be, and based on that, value the remaining convertibles and other strikes accordingly to arrive at a per share value.

Equity Is Equity

Warrants and other equity options issued by the firm are claims on the equity of the firm and must be treated as equity. This is especially important in the context of a company with very high volatility, such as Faron. The valuations can be calculated precisely, and there is no defensible rationale for ignoring them, as they have a material impact on the equity attributable to current shareholders, especially in positive scenarios.

In future, we will publish an article about Faron’s takeover values. That is, the value distributable among the current share count in the event of a buyout. The figures are materially different given the large number of claims on the company’s equity that are not yet reflected in the share count. All of which have exponential return profiles.

CHAPTER 6: Merry Christmas

Rose Garden Capital thanks its readers for the year 2025, and wishes a prolific business year 2026. Remember to love the people around you.

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance. Although every effort is made to ensure accuracy at the time of publication, errors or omissions may occur. Always corroborate key facts with multiple reputable sources and, where feasible, trace assertions back to the original source material. References to third-party content are provided solely for convenience and do not imply endorsement, and no responsibility is assumed for their completeness, reliability, or timeliness. The topics covered are not neccessarily exhaustive.