Faron Pharmaceuticals — Death Spiral Reaches The Bottom

Rose Garden Capital provides an initial comment on Faron's decision to commence a share issue. The decision was expected and follows a clear path.

Faron Pharmaceuticals is a Nordic biotechnology company listed on First North Helsinki and on the AIM market in London. The company develops immuno-oncology therapies with bexmarilimab as the lead asset and is preparing for Phase II/III. Faron is currently in the process commencing a share issue.

This article offers preliminary observations on the proposed share issue and the underlying rationale.

The Proposed Share Issue

On February 9, the company announced plans to raise approximately €40 million through a share issue. The proceeds are intended to fund the dose-optimization phase of the forthcoming phase II/III BEXMAB02 trial.

Liquidity Position

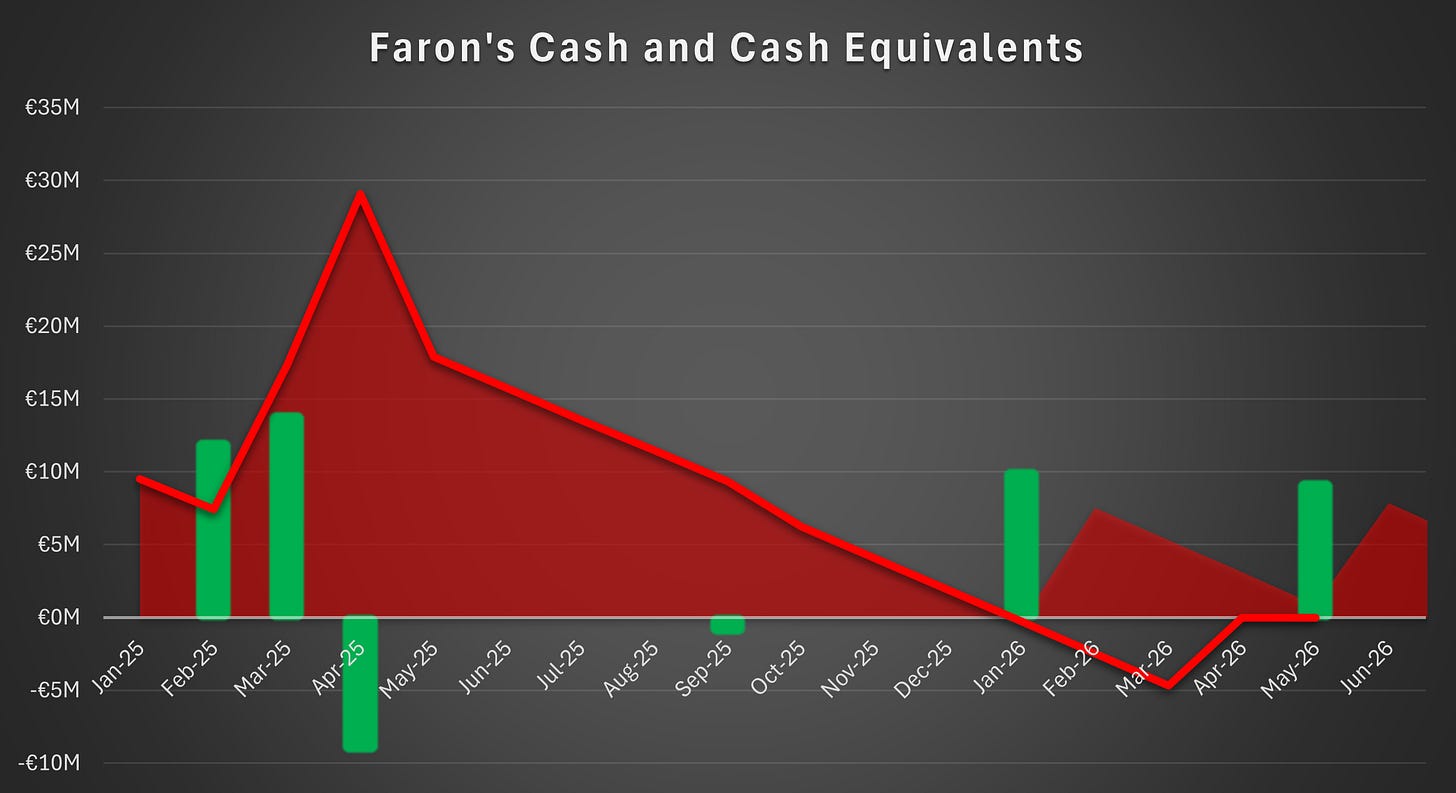

As of February 9, the company held a cash position of approximately €6 million, which is sufficient to fund operations through the end of the second quarter of 2026. However, the initiation of the BEXMAB02 trial requires upfront investments that the company was not in a position to make without additional funding.

Furthermore, the third tranche of the HCM bond, which was discussed in more detail in our earlier issues, included terms that made it unavailable to the company.

Timeline

The proposed share issue exceeds the currently available authorisation. Accordingly, the company has convened an extraordinary general meeting, in order to seek authorisation to issue up to a further 80 million shares. We expect shareholders to approve the proposal.

The company stated that the share issue is expected to commence and conclude during the second quarter of 2026. If this timetable holds, the company can secure the proceeds before running out of cash and thereby avoid having to rely on expensive bridge financing.

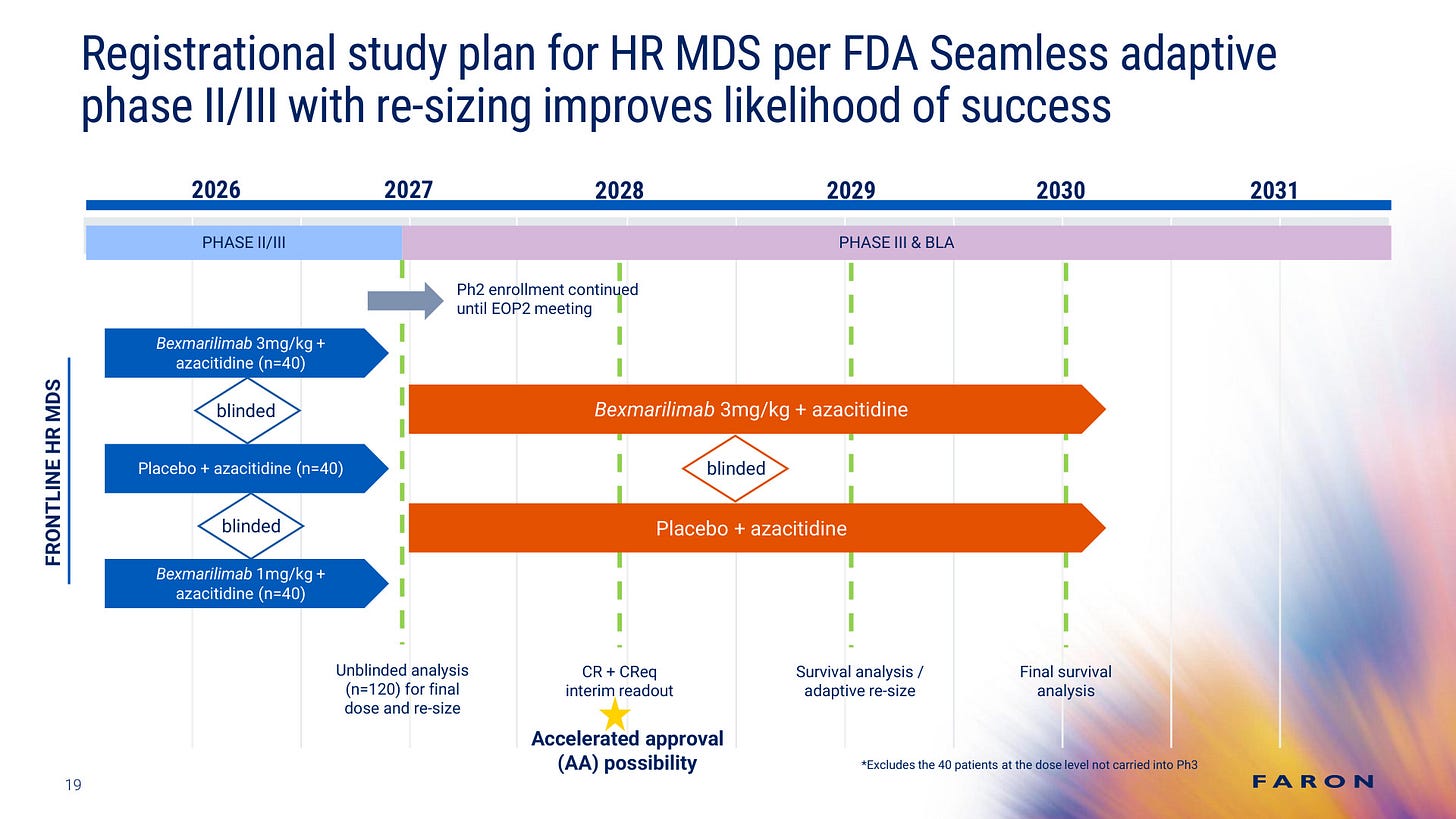

If the company succeeds in raising sufficient capital, we expect the BEXMAB02 trial to commence in late third quarter of 2026, with the first patient recruited by the end of 2026. This would indicate a delay of approximately one year relative to the most recent timeline communicated by the company.

The Reason Behind The Share Issue

The decision to seek equity financing was largely expected given the information previously available. In this chapter, we briefly discuss the relevant factors. For a more detailed discussion, please refer to our earlier issues available at rosegarden.capital.

Faron Assumed the Sponsor Role for the Upcoming Trial

In September 2026, Faron announced three full time positions simultaneously, which appeared to be closely connected to the upcoming BEXMAB02 trial. These vacancies suggested that Faron required additional talent over an extended period. This indicated that Faron had chosen to sponsor at least the initial part of the upcoming trial.

The sponsor of a clinical trial is the responsible party. If a biotechnology company seeks a Big Pharma partner to advance its clinical pipeline, the partner generally assumes the sponsor role for the trial. This is consistent with the underlying nature of a licensing agreement. Situations in which a Big Pharma partner licenses a project from a smaller company and still defers the sponsor role are highly unorthodox. For more information on this topic, please refer to our earlier issue, which discussed licensing deals in more detail.

Faron Has Relied on Predatory Funding Arrangements

A significant share of Faron’s financing has come from Heights Capital Management (HCM), an entity that is widely known to employ predatory lending practices. In such arrangements, it may take advantage of financially distressed companies, such as Faron, by issuing debt instruments that are often referred as junk equity in the academic literature. The use of these unfavourable financing instruments has signalled to potential partners that Faron struggles to secure funding on reasonable terms. This has contributed to a weak negotiating position in licensing discussions.

Faron’s Organisation and Cost Structure Is Very Large for Early Stage Development

Faron’s headcount exceeds 30, which is a high number for a Nordic biotechnology company with a history of financial strain. In addition, Faron has continued to hire experienced professionals who command high salaries. If Faron had outlicensed its lead project at this stage, it is clear that the cost structure would have required adjustment. However, because Faron now aims to secure a licensing deal only after the first controlled readout in 2027, the current organisational structure appears suitable for fulfilling the responsibilities of the sponsor of a pivotal Phase II/III study. It is rare for a company to pursue transactions that would effectively render its existing workforce redundant. This is particularly evident in single project family businesses.

CFO Out

Faron’s CFO, Mr Wichmann, retired in early December 2025, during a period that the company had previously led investors to regard as favourable for partnering discussions. This suggested that any such discussions had either concluded without an agreement or had not taken place in a substantive manner.

In our earlier issue, we considered the possibility that Mr Wichmann had in fact been dismissed. The subsequent announcement suggests that this may have been the case.

Expectations For The Key Parameters

Outstanding HCM Bonds

As of February 9, principal of €17.5 million remains outstanding under the convertible instruments issued pursuant to the HCM loan agreement.

This arrangement casts a shadow over the rights issue, as payments of approximately €1.5 million are scheduled every other month. Given the expected decline in market capitalisation, these payments represent an increasingly large share of trading volume, which may further depress the share price.

We expect the company to be in discussions with the lender regarding the possibility of converting the remaining debt into equity in conjunction with the share issue. This would allow the company to start from a clean slate following the issue. If this occurs, we expect part of the issue proceeds to be set off against the debt, resulting in lower cash proceeds. Furthermore, this would likely lead to a lower subscription price and a fee payable to HCM amounting to approximately 10% to 15% of the principal. This corresponds to €1.75 million to €2.625 million.

Available Authorization To Issue Shares

If the EGM approves the authorisation to issue 80 million shares, an additional authorisation for approximately 15 million shares, stemming from the 2025 AGM, would remain in place alongside the 80 million shares. This would result in a total authorisation of approximately 95 million shares. The proposed authorisation of 80 million shares is relatively limited, which suggests that further issuance may be authorised at the annual general meeting held later in the spring. This is because the special rights attached to the convertible bonds are likely to be insufficient in light of the expected decline in the share price.

However, as the next scheduled payments are due in April 2026, the company can wait before issuing additional special rights. If HCM decides to accelerate any payments, the proposed authorisation may prove insufficient. This could require the board to propose a larger authorisation before the EGM. Furthermore, if HCM acts after the EGM, or if the company’s market price declines, the company may be forced to convene an additional EGM to secure authorisation to issue more shares. Alternatively, the company may need to raise bridge financing in order to fund cash payments in the event of accelerated payments.

The situation is risky for Faron given the predatory nature of the HCM loan agreement. We will provide a more detailed view of the share issue once the final terms are released and the EGM has concluded.

Expenses

We expect expenses to be approximately €3.5 million before accounting for any potential compensation payable to the guarantors of the issue. This figure is relatively high as a result of the dual listing, which is expected to complicate the rights issue.

Furthermore, we expect a guarantee fee of 12.5% to be paid to the guarantors of the issue. We expect the guaranteed amount to be approximately €12 million, which would result in a fee of €1.5 million. This would bring total expenses to approximately €5 million.

The Subscription Price

In theory, the subscription price in the issue is not relevant, as the subscription right is attached to the existing shares. However, in practice, given the large amount of capital the company is seeking and the difficult market environment, there is a substantial risk that the issue will not be fully subscribed. In that case, the subscription rights would be worthless.

Generally, rights issues are carried out at a discount of approximately 30% to 40% relative to the theoretical ex rights price, TERP. However, in Faron’s case, we believe the discount may be materially higher, as failure to raise the targeted amount could lead to disruptions to the company’s operational objectives. Accordingly, we expect the discount to be approximately 40% to 50%.

The final closing price prior to the announcement of the issue was €1.89. Using a TERP discount of 45% and total expenses of €5 million, we arrive at a subscription price of €0.86. This can be considered the upper end of the plausible range of subscription prices. The lower end can be approximated by considering the total number of shares available for issuance and the targeted gross proceeds. Therefore, we forecast the subscription price to be between €0.4 and €0.8, which would correspond to a TERP discount of 48% to 66%. In our next article, we will provide a projection of the outcome of the rights issue.

Thank you for reading. We will publish a detailed article in March that considers all aspects of the upcoming transaction. Please consider subscribing in order to be among the first to gain access.

We are committed to providing free access to our articles for everyone. Furthermore, we guarantee that we will not display advertisements or employ paywalls.

Until March, you may be interested in reading some of our earlier articles on Faron. Below are some articles that you may find useful, presented in chronological order.

Jun 24, 2025 — Faron Pharmaceuticals — A Share Issue Would Drive Value

Jul 24, 2025 — Faron Pharmaceuticals — Transforming Value From Shareholders to HCM

Aug 19, 2025 — Faron Pharmaceuticals — Navigating the Financing Choices to Phase III

Oct 06, 2025 — Faron Pharmaceuticals — Ahead of Critical Decisions

Dec 15, 2025 — Faron Pharmaceuticals — Death Spiral Deepens

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance. Although every effort is made to ensure accuracy at the time of publication, errors or omissions may occur. Always corroborate key facts with multiple reputable sources and, where feasible, trace assertions back to the original source material. References to third-party content are provided solely for convenience and do not imply endorsement, and no responsibility is assumed for their completeness, reliability, or timeliness. The topics covered are not neccessarily exhaustive.